The success story of the Würth Group began on a very small scale back in 1945. In the early days, the goods offered by screw wholesaler Adolf Würth were still brought to Künzelsau train station by cart before being transported to the company’s customers from there. In the space of 75 years, the two-man business has evolved into a global trading group with 79,139 employees, over 33,000 of whom work as members of the sales force. Thanks to its worldwide presence, the company now reaches customers across the globe.

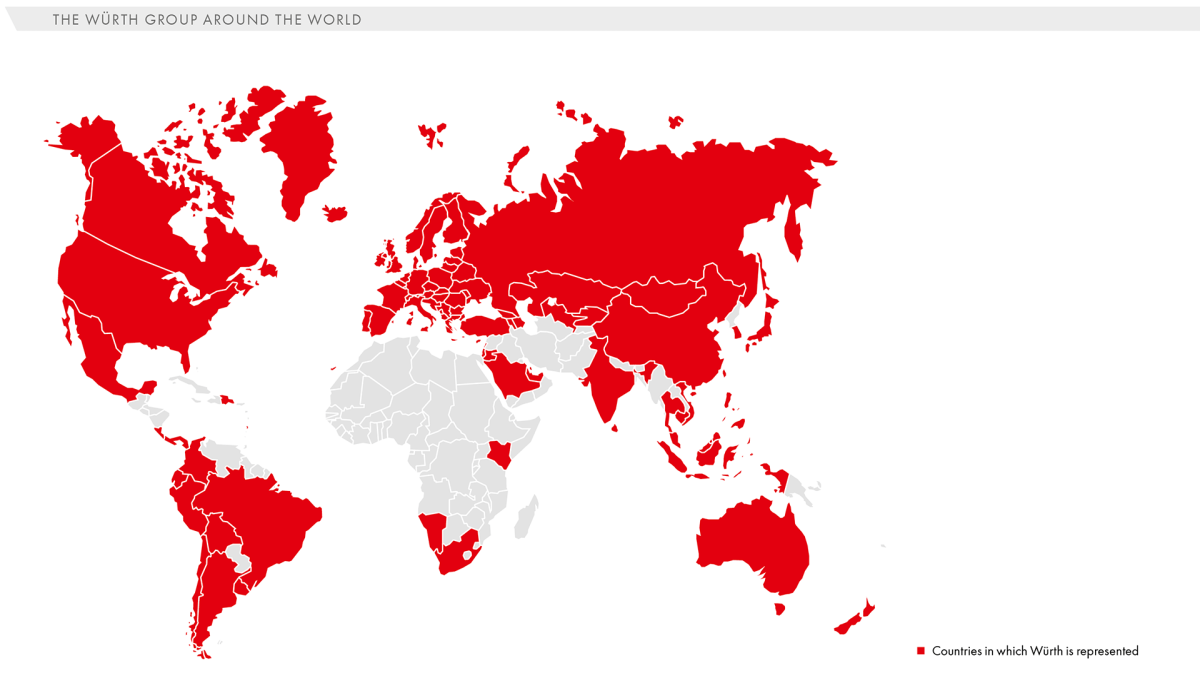

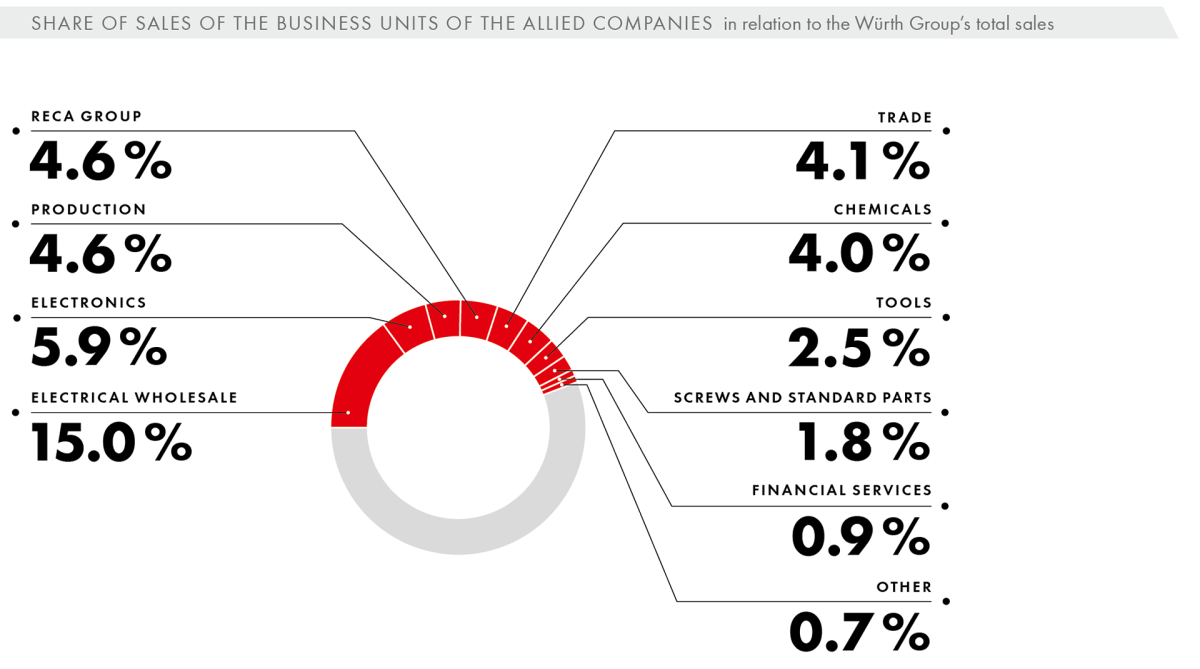

In its core business, the sale of assembly and fastening materials, the Würth Group is a firmly established market player. Other trading and production companies, known as the Allied Companies, operate in related business areas, ranging from the electrical wholesale and electronics to financial services. The Würth Group comprises more than 400 companies represented by around 2,300 branches in more than 80 countries. The Group generated sales of EUR 14.4 billion in the 2020 fiscal year.

In its anniversary year of 2020, Adolf Würth GmbH & Co. KG, the nucleus of the company, looked back on its 75-year success story. At the same time, Reinhold Würth, who took over the business at the age of 19 following his father’s death, also celebrated his 85th birthday. The family business serves as a role model in terms of its social and cultural commitment.

Today, the Würth Collection comprises more than 18,300 works of art that can be seen in five museums and ten associated galleries of the Würth Group across Europe. As recently as June 2020, Museum Würth 2 opened its doors to the public as an extension of Carmen Würth Forum at the company’s Gaisbach location. The museum showcases centerpieces of modern and contemporary art from the Würth Collection. Reinhold Würth is convinced that the juxtaposition of art and day-to-day working life provides inspiration for new ideas. All of the company’s museums are open to the public with free admission.

Over its 75-year history, the company has repeatedly pursued new avenues and, as a family business, its actions are geared towards ensuring sustainable and long-term growth. At the same time, the Würth Group is particularly aware of its social responsibility and, alongside its commitment to art and culture, is involved in a large number of initiatives in areas such as sports, social affairs, and education.

A wide array of activities has also been launched to promote environmental sustainability, most of them still at the level of individual companies. The Central Managing Board has decided to bundle these activities within the Würth Group and, in this context, to lay the foundation for Group-wide reporting, including quantitative targets. A sustainability report is planned to provide information on these efforts at the Group level in 2022.

But even when venturing down new avenues, the company always remains loyal to its philosophy and values: Openness, gratitude, respect, curiosity, responsibility, and humility are the cornerstones of our success and form the basis for our cooperation with each other, with our business partners and with our customers. This is the strategy that has accompanied us for 75 years and will continue to accompany us going forward. Corporate culture at Würth? Like!

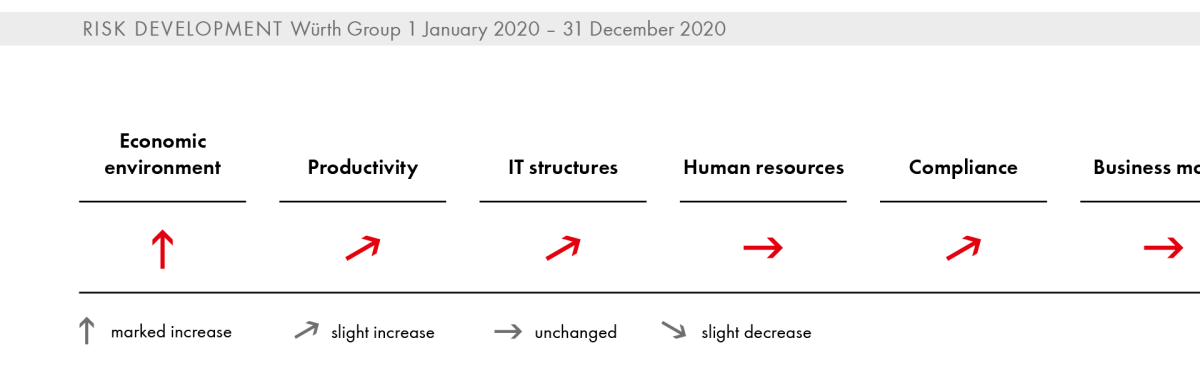

The COVID-19 crisis plunged the German economy into the second most severe recession witnessed in the post-war era. Over and above the battle against the pandemic, events were dominated by ongoing tension in the South China Sea and the Middle East, a growing wave of populism and protectionism associated with Brexit, and the unpredictable nature of Donald Trump’s US presidency. The escalating trade dispute between the US and China and the ongoing quarrels over the future of the EU were also major factors in 2020.

These risk factors were not new and had been taken into account worldwide. The situation with the hitherto unknown SARS-CoV-2 virus was a different matter entirely: It triggered the biggest economic slump seen in modern times. It was not possible to correct the marked downward trajectory before the end of the year. According to the World Bank, global economic output fell by 4.3 percent in 2020, compared with 2.8 percent growth one year earlier. With only a slight increase in gross domestic product in China (+ 2.0 percent) and a contraction in the US (–4.6 percent), the world’s two largest economies lost considerable steam.

- COVID-19 pandemic sends shockwaves through German economy after ten-year growth phase

- Economic slump in almost all sectors of economy—service sector and parts of industry hit particularly hard

- Construction only exception with 2.8 percent increase in gross value added

Economic output in Germany, the Würth Group’s largest single market, plunged by 5.0 percent last year (2019: + 0.6 percent). The only time the economy showed a more dramatic contraction was during the global financial crisis in 2009, when gross domestic product (GDP) plummeted by 5.7 percent. Employment also declined overall: The unemployment rate averaged 5.9 percent in 2020 (2019: 5.0 percent).

Compared with the eurozone, Germany has nevertheless fared relatively well during the crisis. The construction industry in particular, a sector of the economy that is especially important for Würth, made a significant contribution to the trend. While macroeconomic gross output (excluding construction) declined in 2020, it increased by 2.8 percent in the construction sector (2019: + 4.0 percent). In the mainstream construction sector, sales rose by 5.9 percent in nominal terms (2019: 6.7 percent). In addition, the corporate sector created roughly another 22,500 new jobs in 2020 (2019: + 33,385). Last year, incoming orders rose by 0.5 percent in nominal terms (2019: + 8.2 percent), but fell slightly by 2.6 percent in real terms (2019: + 3.0 percent). This can be explained by various COVID-19-related restrictions, such as isolated construction site shutdowns, the partial unavailability of foreign skilled workers due to border closures, or missing material deliveries and canceled orders.

It was a similar story in the trades, another decisive key market for the Würth Group: Here, sales were 1.4 percent higher in 2020 than they had been in 2019 (+ 3.9 percent). Despite the positive figures, the industry recorded the weakest sales growth witnessed in the last seven years. Numerous companies are still struggling due to the shortage of skilled workers. A large number of vocational traineeship positions remained unfilled. What is more, craft businesses have a number of bureaucratic hurdles to overcome, which also has the effect of inhibiting growth.

Since 2018, companies in the metal and electrical industry (M+E) have been grappling with a recession and an urgent need for structural change, including digital transformation. This was compounded by the effects of the COVID-19 pandemic last year. After 2019 saw a decline of 4.5 percent, 2020 was the second year of severe recession for the M+E industry, another key pillar for the Würth Group. Looking at 2020 on average, M+E production was down by 14.1 percent on the previous year. The job creation witnessed in recent years came to an end in mid-2019. The export-oriented mechanical engineering sector also recorded a 14.0 percent slump in production in 2020 (2019: – 2.0 percent). One reason for this was the sharp decline in production in the automotive industry due to the crisis. Last year, the number of vehicles sold by car manufacturers was down by almost one-fifth on the year before. A total of 2.9 million new cars were registered in 2020, 19.1 percent less than in 2019 (2019: – 5.0 percent). This development was replicated across the globe: Sales bans, economic uncertainty, and production downtimes translated into negative results in Europe, as well as in Asia, Russia, and the United States.

The picture for the eurozone as a whole is even bleaker: The European Commission estimates that GDP contracted by 6.8 percent in 2020 (2019: + 1.3 percent). Economic output in other major EU countries, France, Italy, Spain and Great Britain, for example, fell by between 8.3 percent and 11.0 percent. Unemployment in the EU also soared in a year dominated by COVID-19. Almost two million more people found themselves out of work. As a result, the unemployment rate rose from 6.5 percent in December 2019 to 7.5 percent at the end of 2020, according to Eurostat.

France was forced to impose another hard lockdown starting in November 2020 to control the COVID-19 outbreak. Thus, the European Commission expects GDP to have declined by 8.3 percent. GDP was still growing at a rate of 1.5 percent in 2019. The unemployment rate has increased in France: from 8.5 percent in 2019 to 8.9 percent in 2020.

Italy was able to contain the spread of infection in the fourth quarter by taking distinct measures for each region. This allowed it to prevent the sort of full nationwide lockdown seen in the spring. For 2020 as a whole, experts at the European Commission predict an 8.8 percent drop in GDP (2019: + 0.3 percent). In 2019, the unemployment rate was 9.9 percent, while it rose to 11.0 percent during the COVID-19 crisis.

Spain, much like Italy, responded to the renewed rise in infections in the fall by implementing a range of different measures according to region. Nevertheless, economists predict that growth in Spain will have slumped by 11.0 percent (2019: + 2.0 percent), which is also reflected in a very high unemployment rate of 16.8 percent (2019: 14.1 percent).

The COVID-19 pandemic and partial economic standstill maneuvered Great Britain into an economic crisis of historic proportions in 2020. A healthcare system on its last legs after years of funding cuts, an extremely high population density, and political failures on a massive scale allowed the virus to spread widely unchecked. For the year as a whole, Great Britain recorded a 9.9 percent drop in economic output (2019: + 1.5 percent). The unemployment rate also increased by 1.6 percentage points to 5.4 percent (2019: 3.8 percent).

China is the only major economy that did not contract in 2020. With GDP growth of 2.0 percent (2019: + 6.1 percent), the People’s Republic can report higher growth than any other country, but also hefty losses as a result of COVID-19.

Tough measures to contain the pandemic also slammed the brakes on India’s economy. GDP slumped by 9.6 percent in 2020 (2019: + 4.2 percent).

In the US, GDP contracted by 4.6 percent (2019: + 2.2 percent). While the government was late in its response to the pandemic, it went on to launch a generous rescue package.

Last year, Latin America’s economy experienced the biggest economic slump in decades. Gross domestic product fell by an average of 7.6 percent in 2020 (2019: + 0.1 percent).

Last year was also dominated by a barrage of bad news for the Russian economy. Production closures due to the lockdown to combat the COVID-19 pandemic, the slump in oil prices, and the depreciation of the ruble sent GDP sliding by 4.0 percent (2019: + 1.3 percent).

- Sales up slightly to EUR 14.4 billion

- Operating result slightly above previous year’s level

- Digitalization drive ensures above-average growth in e-commerce business

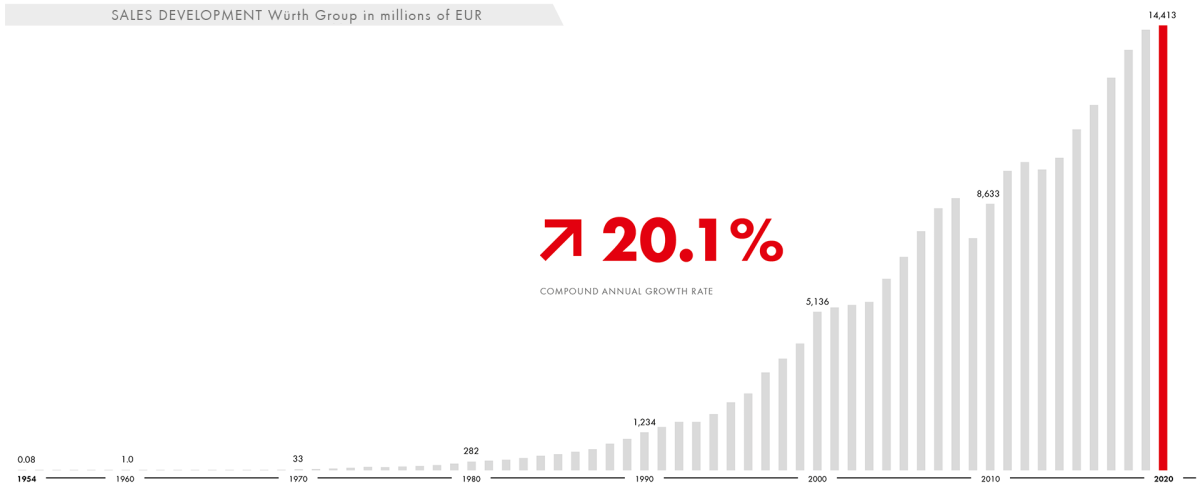

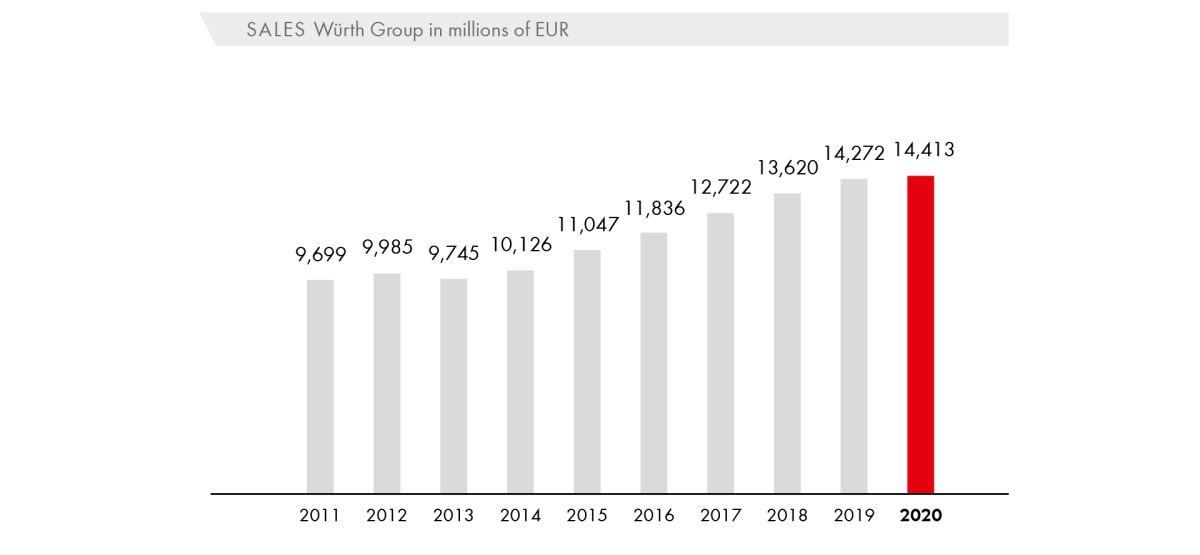

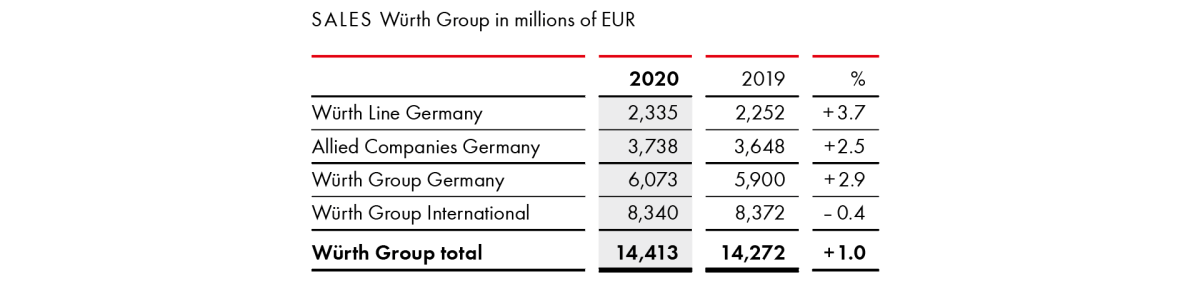

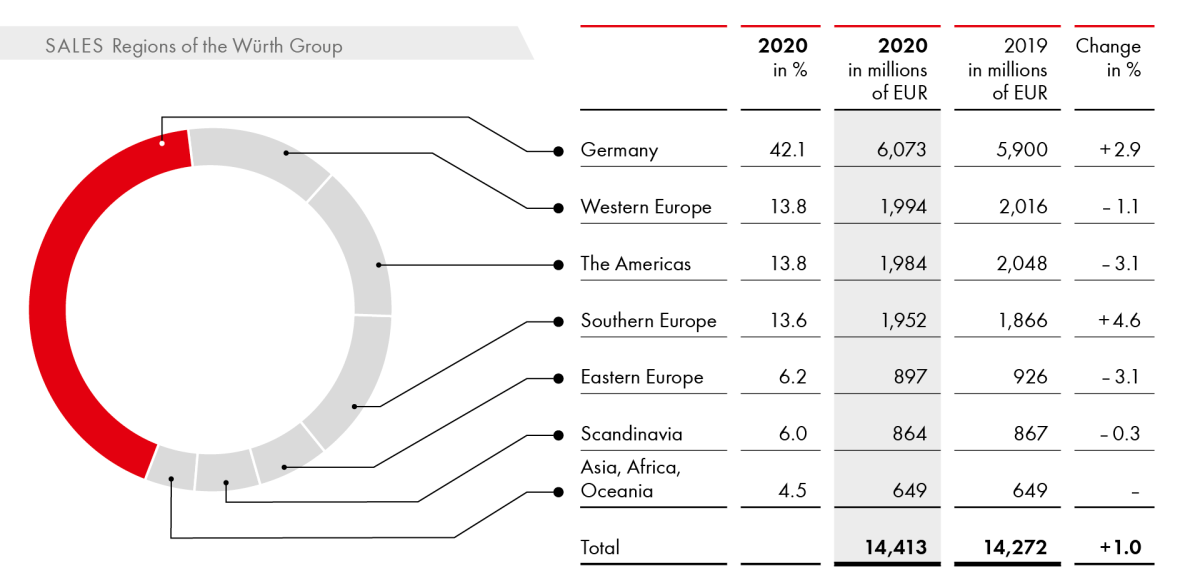

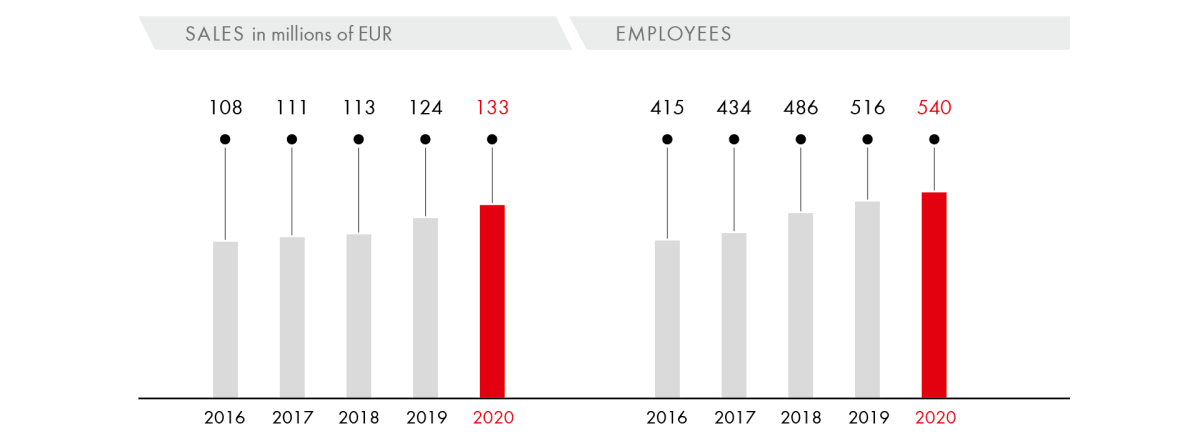

In 2020, the Würth Group generated sales of EUR 14.4 billion, up slightly on the previous year (2019: EUR 14.3 billion). This represents growth of 1.0 percent. After adjustments to reflect exchange rate effects, the rate of growth came out at 2.0 percent.

The recurring theme of 2020 was the COVID-19 pandemic with its huge global impact. The economic development of the Würth Group was also heavily influenced by the pandemic. While sales slumped by more than 20 percent in April 2020, with the decline making it into the double digits again in May 2020, growth improved month over month thereafter, resulting in double-digit sales growth in December, which allowed the Group to close the fourth quarter of 2020 with the strongest growth.

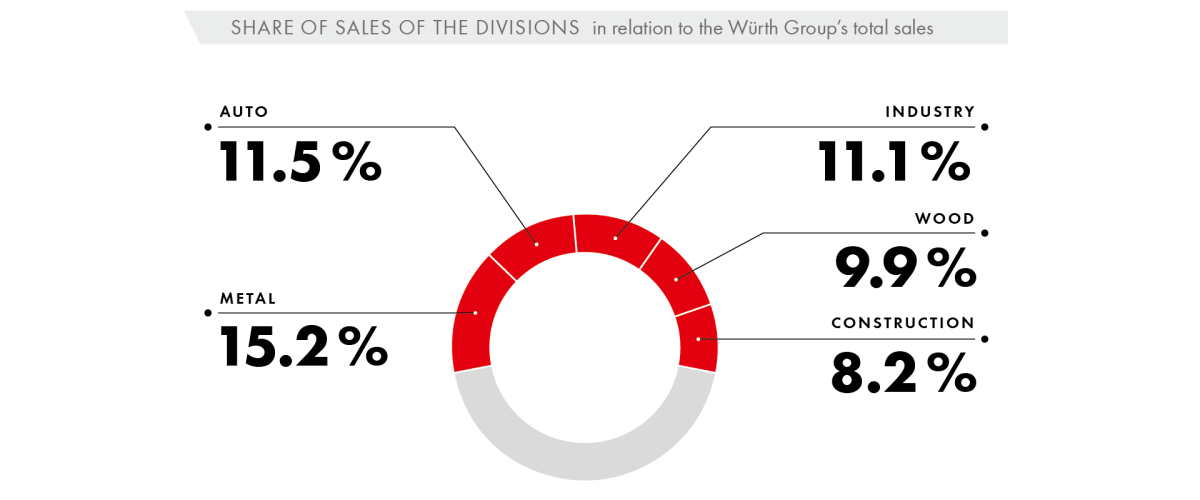

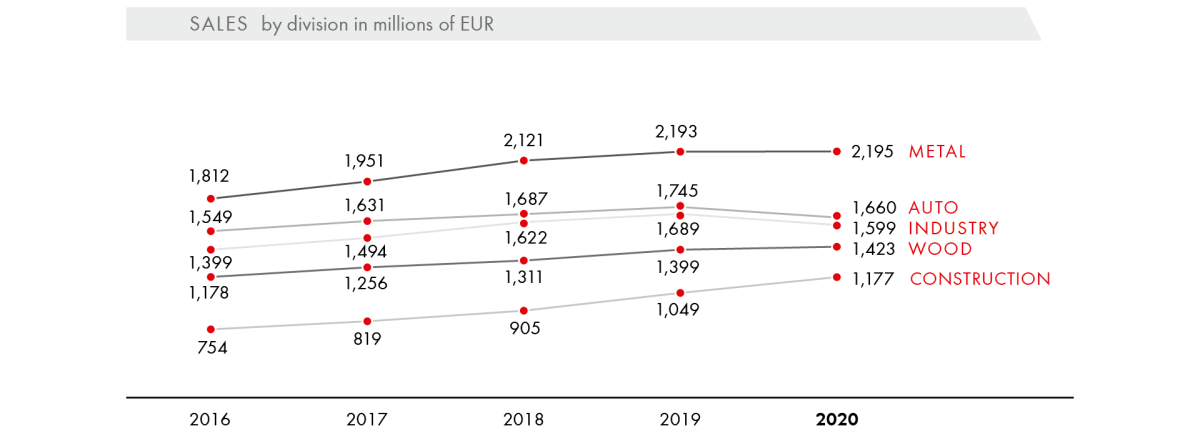

The Group maintained its performance at a high level thanks to its multi-channel strategy, the diversification of risk resulting from its international positioning and also diversification across various business areas. The 2020 sales trend also reflects the varying impact that the pandemic had on individual sectors and markets: While the Construction division (+12.2 percent) and Electrical Wholesale Germany (+10.8 percent) performed very well, reporting double-digit sales growth, sales in areas that are direct suppliers to the automotive and mechanical engineering industries declined.

Germany proved to be very robust during the COVID-19 pandemic. The Würth Group achieved 2.9 percent growth in this market, with Adolf Würth GmbH & Co. KG, the nucleus of the Group, growing by 7.4 percent. Outside of Germany, the Group saw its sales drop by 0.4 percent.

E-business sales showed above-average growth of 5.8 percent, climbing to EUR 2.8 billion in 2020. This brought their share of Group sales up by one percentage point to 19.3 percent. Due to contact restrictions and lockdowns, business shifted increasingly to digital sales channels. Be it via the online shop, the Würth App, or e-procurement solutions: Thanks to the systematic pursuit of its digitalization strategy and its financial stability, Würth remained a reliable partner and supplier to its customers even during the pandemic. E-business has become even more important as part of the multi-channel strategy.

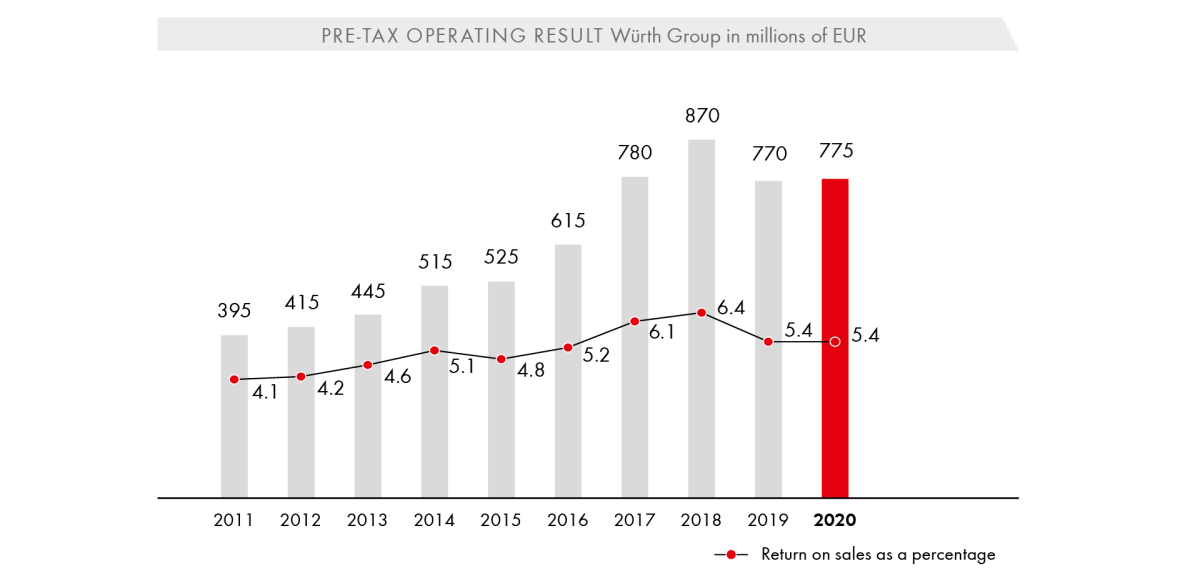

At EUR 775 million, the operating result was up slightly year on year (2019: EUR 770 million). This is a very good result considering the global pandemic and was achieved thanks to stringent cost discipline and relatively stable gross profit margins. The rate of return remained constant year on year at 5.4 percent (2019: 5.4 percent). In order to implement its planned strategies, the Würth Group is making sustainable investments in its various business areas and markets. Capital expenditure on intangible assets and property, plant and equipment came to EUR 473 million in 2020.

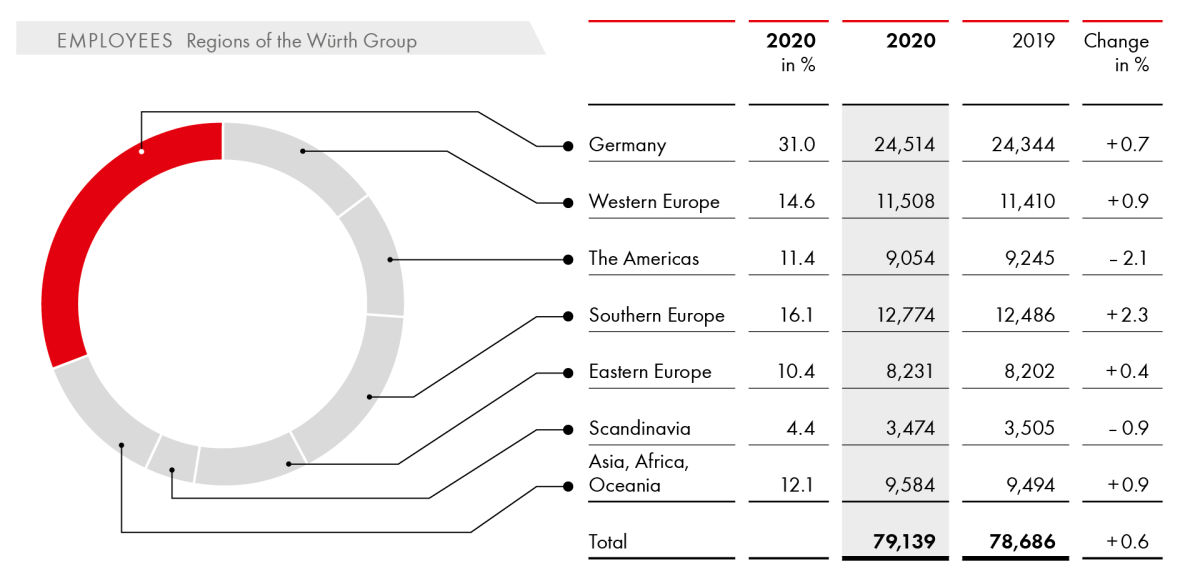

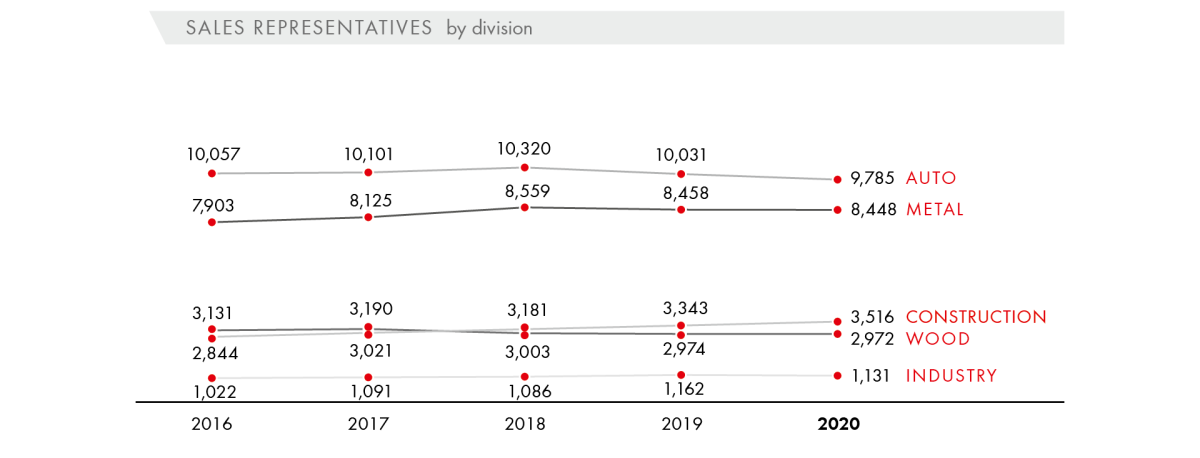

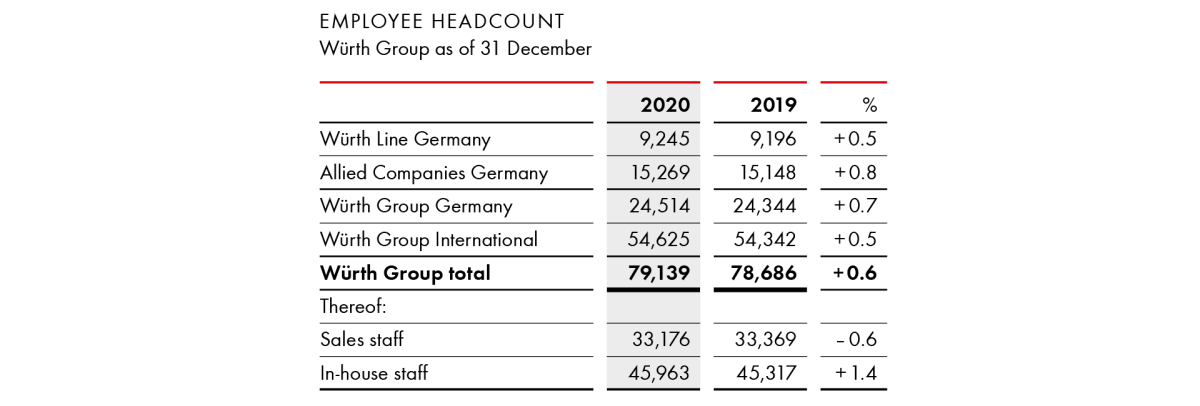

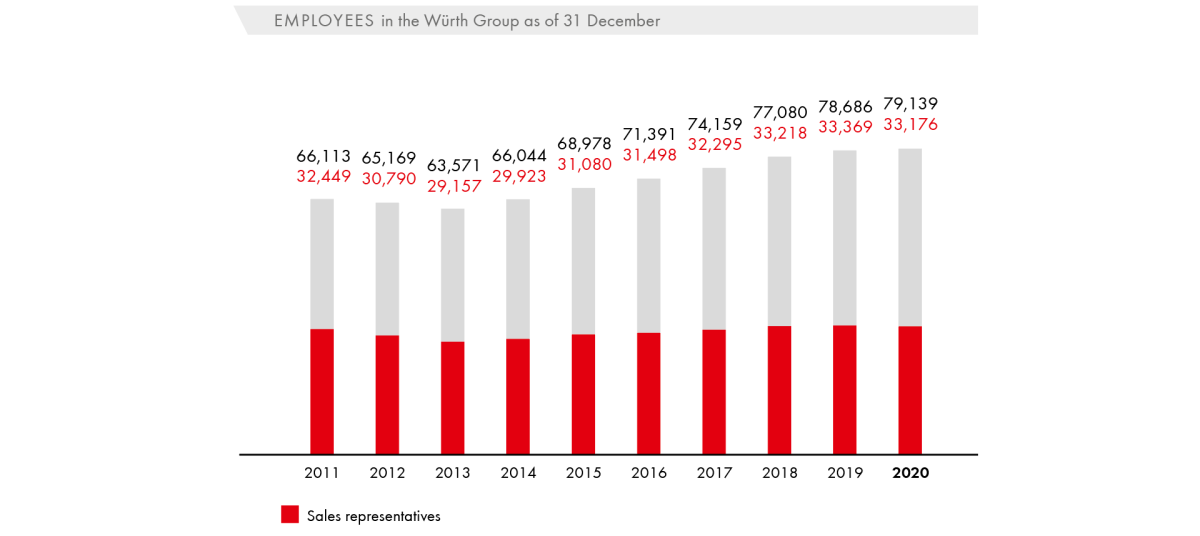

Despite the COVID-19 crisis, the Würth Group did not implement any structural job cuts. On the contrary: In 2020, the number of employees increased by 453 from 78,686 to a new high of 79,139. The number of employees in Germany is now 24,514, representing an increase of 0.7 percent. As in the past, the majority of the employees are still based in Germany. Würth is a sales company at its core. Including sales-related areas, almost 50,000 employees have direct contact with customers, with 33,176 of them working as sales representatives.

- COVID-19 pandemic hampers Würth Group growth worldwide

- Germany remains biggest individual market

- Spain benefits from company acquisition

Germany is the most important individual market for the Würth Group, accounting for 42.1 percent of sales. Although the growth momentum in 2020 varied considerably from business unit to business unit, a satisfactory result was achieved overall with 2.9 percent growth in Germany. Outside of Germany, the companies recorded a 0.4 percent drop in sales, almost all of which was attributable to the COVID-19 pandemic and the associated restrictions and which affected virtually all continents and regions.

Decentralization has always been one of the Würth Group’s strengths. In 2020, geographical diversification was particularly helpful to us, as the more than 400 companies in over 80 countries were affected by the pandemic to very different degrees. The lockdowns imposed varied in their timing, intensity, and length, and the classification of the systemic importance of our business units also differed from region to region. We were hit by temporary restrictions on customer visits by sales representatives, pick-up shop closures, and even by the closure of national companies in some cases.

The multi-channel strategy we have been pursuing for years now proved all the more successful. In addition to telephone sales, the focus on e-business was a key component of our sales activities as we sought to maintain proximity to our customers and ensure that they were supplied with materials.

In the 2020 fiscal year, sales of EUR 6,073 million were generated in Germany, up by 2.9 percent (2019: EUR 5,900 million). Against the backdrop of the COVID-19 pandemic, this is a very positive development. The German companies benefited from buoyant construction activity in both the private and public sectors, as well as from their stable business models, allowing them to respond very quickly to the challenges associated with the onset of the COVID-19 crisis in Germany from March and April 2020. The companies in the German Electrical Wholesale unit showed particularly encouraging development, led by Fega & Schmitt Elektrogroßhandel GmbH, which reported a double-digit increase in sales, although companies in the chemicals sector also reported encouraging development. Companies that are direct suppliers to the automotive and mechanical engineering sectors and had already been affected by the downward trend in these sectors were hit hard by the COVID-19 pandemic. By way of example, this translated into lower sales at the subsidiary Arnold Umformtechnik, which specializes in connection technology for the automotive manufacturing industry. Our major German tool distributors Hahn+Kolb, Sartorius, and Hommel Hercules also reported declining sales.

Developments at Adolf Würth GmbH & Co. KG tell a completely different story. Established back in 1945, it is the nucleus of the Würth Group and celebrated its 75th anniversary in 2020. It started operations on 14 July 1945 in Künzelsau as the screw wholesaler Adolf Würth. This marked the first chapter in the story of a global corporation. In the fiscal year under review, its 7,477 employees reached another milestone, generating sales of EUR 2,215 million, including intra-Group sales. This corresponds to an increase of 5.8 percent, outstripping the average figure for the Group by a wide margin. Alongside the sales force and in-house sales staff, the more than 550 pick-up shops are key to the company’s positive development. Even during the lockdown phases in Germany, these shops were open throughout due to their systemic importance, and our customers were able to cover their immediate needs at any time. This puts our Group’s flagship closer to our customers than any of our competitors. The response to physical distancing was a successful further expansion of e-business reliant on trust-based cooperation between sales force employees and our customers. Professionalism, both internally and externally, is one of the reasons behind the company’s high level of profitability. For the first time in the Würth Group’s history, a company managed to achieve an operating result in excess of EUR 200 million.

This earnings power is also a prerequisite for investments in forward-looking sales, logistics, and product solutions, for instance, the construction of the new Innovation Center that is being built on the campus in Künzelsau.

Overall, Germany accounted for an operating result of EUR 376 million (2019: EUR 389 million), making it the most profitable region.

Western Europe is home to many of the Group’s more established companies as it was there that the internationalization of the Würth Group began: one of the Group’s major success factors. Sales were down only slightly, by 1.1 percent to EUR 1,994 million. The region benefited from the continued positive development of the companies in Switzerland, especially the Swiss direct selling company, which was able to shift up a gear again after a period of restructuring. The companies in Austria were able to maintain the sales level they achieved in 2019. France is the country with the highest sales in the region, accounting for a share of over 35 percent. The companies based in France were able to hold their own relatively well during the COVID-19 crisis. Despite a macroeconomic downturn—including a full lockdown in the month of April and a large number of restrictions in May—considerable success was achieved in e-business. By way of example, the strategic focus on digital channels such as the online shop, the Würth App, and e-procurement led to 29.1 percent growth in Würth France’s e-business segment. The United Kingdom is also part of the Western European region. It is impossible to assess conclusively whether the 7.6 percent drop in sales in local currency terms in 2020 is an early consequence of Brexit or can be traced back to the COVID-19 pandemic.

The Americas, which includes both the US and Brazil, make up the continent that has been hit the hardest by the COVID-19 pandemic. In 2020, over 27 million people were infected in these two countries alone, with severe secondary effects on private and public life. In particular, the drop in sales witnessed during the first wave of the pandemic in April and May 2020 prevented the region from reporting better performance, with sales down by 3.1 percent in total. The strong euro also held sales growth back. In local currency terms, sales in the Americas region were slightly higher than in the previous year. In the US, the largest single market, developments varied significantly from business unit to business unit. Companies with significant activities in the personal protective equipment or chemicals product segments closed the year significantly better than those that rely heavily on the industrial sector.

Another dominant topic last year was the US election campaign, the outcome of which has global implications far beyond the country’s own borders. The traditional pillar of the US economy, a low unemployment rate, relinquished some of its strength last year. Millions of people in the US have lost their jobs as a result of the crisis. From the Würth Group’s perspective, it is also crucial for private consumption in the US to be stimulated again and for global trade conflicts to be contained.

The companies in South America were able to close the year with respectable sales growth of 10.1 percent in local currency terms thanks to a strong fourth quarter of 2020.

Apart from Germany, Southern Europe was the only region to record an increase in sales. The 4.6 percent growth was, however, boosted by the 2019 acquisition of Grupo Electro Stocks, S. L. U., headquartered in Barcelona, Spain. It has always been part of the Group’s growth strategy to add targeted acquisitions to successful business areas where it makes sense to do so. After adjustments to reflect this acquisition, the Southern European companies closed the 2020 fiscal year with a 4.2 percent drop in sales. In terms of the absolute share of sales, Italy is the dominant country in the Southern European region, followed by Spain. In both countries, the effects of the first wave of COVID-19 in Europe were particularly dramatic. By taking fast, systematic action in response to the truly exceptional situation, supported by many years of trust-based cooperation with customers and suppliers, the Würth Group was able to generate growth over the year as a whole that can be considered satisfactory given the circumstances. In order to continue to drive growth dynamically in the region in the future, the number of employees was increased by 2.3 percent. Out of the 12,774 employees, more than 60 percent work as sales representatives.

Sales in Eastern Europe slid by 3.1 percent; in local currency terms, the region remained on a par with the previous year. Countries such as Estonia, Hungary, and Russia also proved that growth can be achieved even in difficult times. The Würth Group employs more than 8,200 people in the region.

The structure of companies in the Scandinavian region has been relatively stable in recent years, which also reflects the maturity of the market. This stability was also evident in 2020, when sales charted only a very slight decline of 0.3 percent. This region is home to one of the model companies in the Würth Group, Würth Finland. With more than four decades of operations under its belt, the company consistently impresses with its excellent market penetration and high profitability. Würth Finland also spearheaded the spread of the successful “pick-up shops” sales concept within the Würth Line. The company now has 189 pick-up shops, four of which were added over the last 12 months.

Asia, Africa, and Oceania still only play a minor role for the Würth Group at present. The share of sales attributable to this region has been stable at a level of under five percent for years now.

The divisions of the Würth Line

Würth Line operations focus on assembly and fastening materials, supplying customers in both trade and industry. Within the Würth Line, the operating business units are split into Metal, Auto, Industry, Wood, and Construction divisions.

Metal division

The Metal division offers its customers innovative solutions to support them in their daily work today and in the future. Our core competency, direct selling, coupled with our pick-up stops and the various options for placing orders online, allows us to offer our customers top-quality advice and options for purchasing our products to suit everyone.

Metal subdivision

This subdivision directly serves customers in the metalworking and metal processing industries, and its main customers include metal and steel fabricators, fitters, and machine and vehicle manufacturers.

Installations subdivision

This subdivision concentrates on electricians, gas, heating and water installation firms, and air-conditioning and ventilation system engineers.

Maintenance subdivision

This subdivision addresses customers with in-house repair shops from a whole range of sectors, such as industrial enterprises, hotels, shopping centers, airports, and hospitals.

Auto division

Proximity to customers is a key success factor for the Auto division, along with an extensive range of top-quality products, as well as systems and services that make our customers’ processes easier and more efficient. In complementary specialist areas such as the special tools segment, we help our customers to meet the rapidly changing demands of the automotive and commercial vehicle market. We also offer solutions for alternative drive systems and the increasing digitalization in the automotive aftersales segment.

Car subdivision

The customers in the car subdivision include vehicle manufacturers, brand-specific and independent car dealers, customers with large vehicle fleets, bodywork specialists, vehicle restorers, tire changing businesses, and businesses in the bike segment.

Cargo/Commercial Vehicles subdivision

The customers of this subdivision are authorized commercial vehicle repair shops, independent commercial vehicle repair shops, repair businesses focusing on construction and agricultural machinery, transportation and logistics companies, bus companies, businesses specializing in repairing and renting working platforms and forklifts, public-sector municipal utilities and waste disposal companies, as well as companies from the agricultural and forestry sector.

Industry division

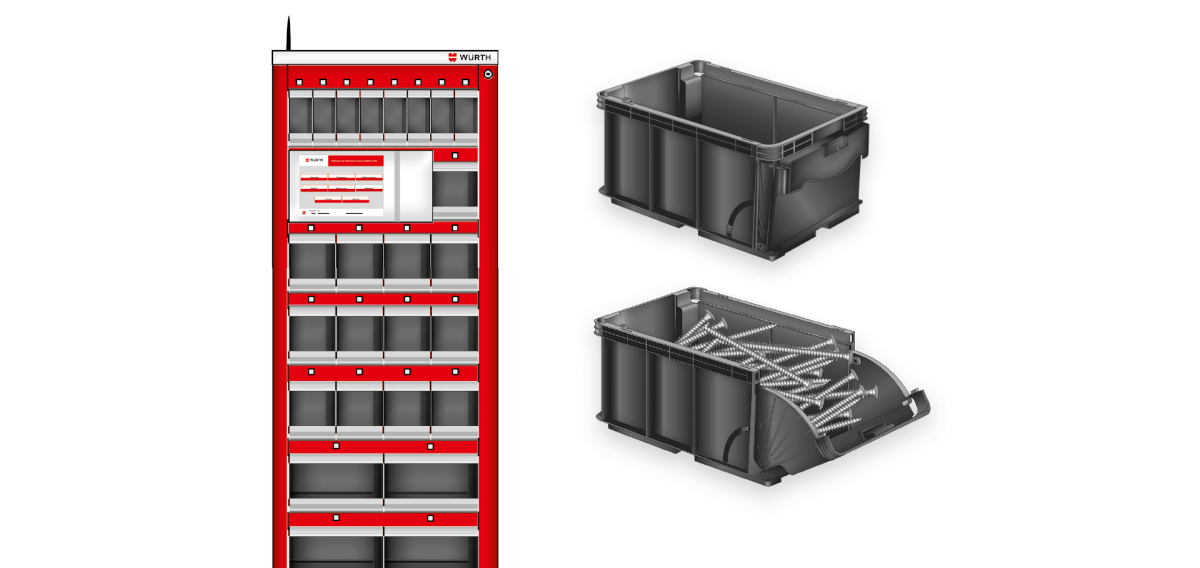

The entities of the Industry division are specialized companies with a complete range of assembly and connecting materials for industrial production, maintenance, and repair. In addition to this comprehensive standard range, the division’s strength lies in customized logistics concepts for supply and service, along with the provision of technical consulting.

The innovative further development of procurement and logistics systems within the Industry division emphasizes the role of full automation and systems in stocking and replenishing Würth products for manufacturing customers. One key focus remains the maximum security of C-part supplies directly at the place of consumption, in the warehouse and at the workstation. All solutions are made available as part of a holistic approach to the supply of production and operating resources. As in the past, the focus is on expanding digital processes and sales channels.

The strategic focus remains on personal on-site customer service thanks to a global network of companies and, as a result, the same high standards for quality, products, and processes across the globe.

Wood division

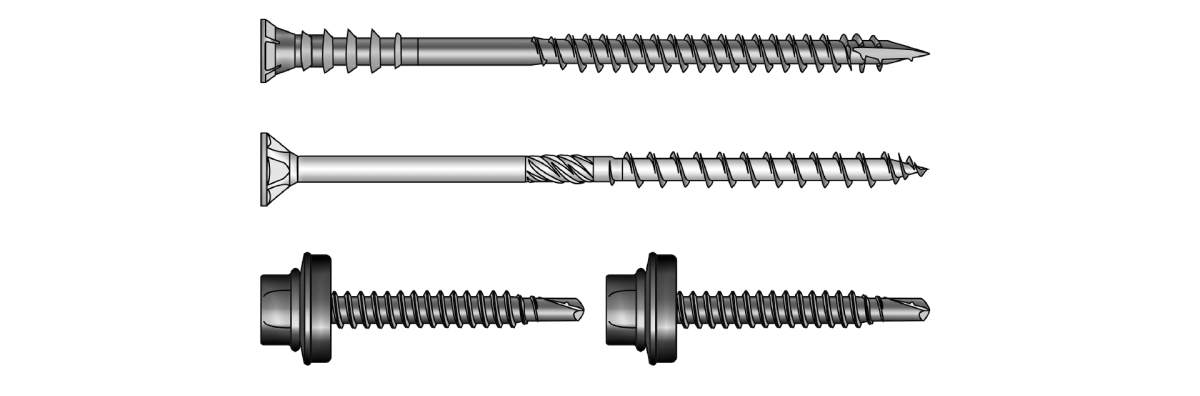

The Wood division supports its customers in the entire woodworking and wood processing trade with a tailored product portfolio and specific application solutions. The product range includes wood screws, fittings, chemical-technical products, as well as material treatment and structural connection products.

Thanks to a high level of expertise and holistic sales solutions, we not only offer our customers products that are perfectly tailored to suit their needs, we also see ourselves as a personal advisor, assisting our clients from the preparation of their initial plans to the completion stage.

In these endeavors, the Wood division is responding to the latest trends in the industry: The WÜDESTO online configurator already allows customers to create customized furniture elements and order semi-finished parts with exact dimensions in Germany and Austria.

Construction division

The Construction division aims to supply construction companies across the globe at the regional, national, and international level with high-end products and services that are as standardized as possible. The pick-up shops are the ideal port of call for customers looking to cover their immediate needs. Sales representatives act as a permanent point of contact at the construction site. They are responsible for optimizing the processes associated with the main trades involved in the shell construction phase and in the various technical building installations as part of the project business.

The Construction division encompasses all sales units responsible for serving customers in the building and civil engineering industry and the finishing trades. Cultivation of the market focuses on construction companies, technical building equipment, roof and wood construction customers, finishing and facade specialists, and direct supplies to construction sites. Customized service and logistics solutions are also provided, such as equipped material stores directly at the construction site. There is an increasing focus on strategic target groups such as builders, planners, architects, and project managers.

The business units of the Allied Companies

The Allied Companies operate either in business areas related to the Group’s core business or in diversified business areas, rounding off the Würth Group’s portfolio. They are divided into nine strategic business units. With the exception of a small number of manufacturing companies, the majority are sales companies operating in related areas.

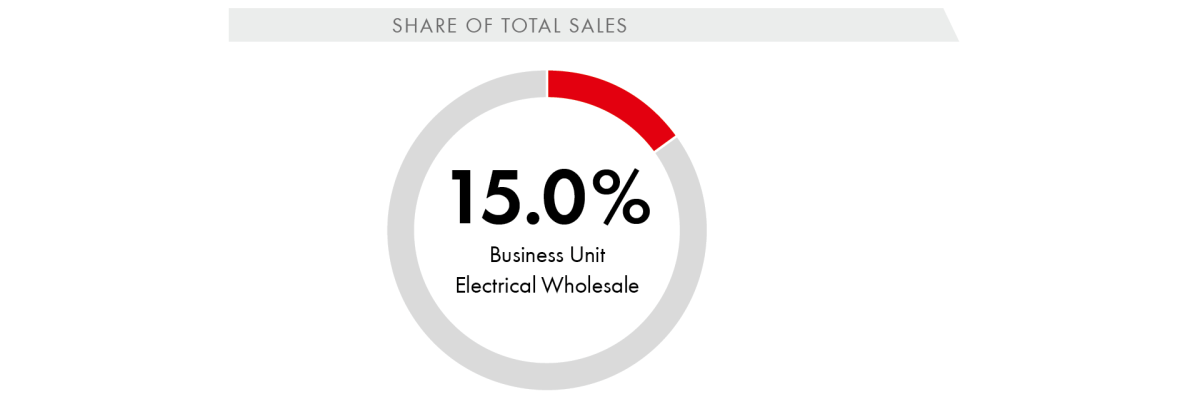

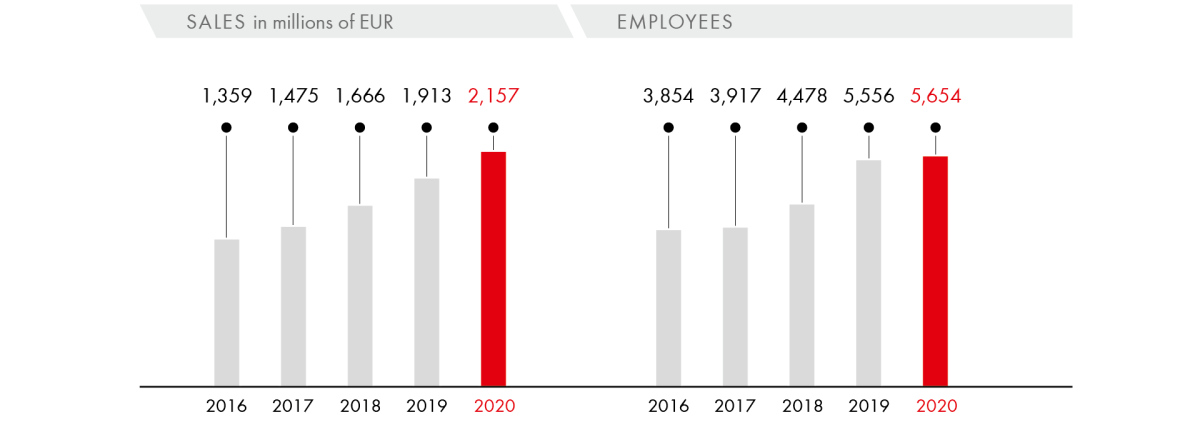

Electrical Wholesale

The business activities of these companies include products and systems covering the areas of electrical installation, industrial automation, cables and lines, tools, data and network technology, lighting and illumination, household appliances and multimedia products, as well as electrical domestic heating technology and regenerative power generation. Trading activities are supplemented by extensive consultancy and service ranges and are aimed at professional customers from the trade, industry, and retail/wholesale sector.

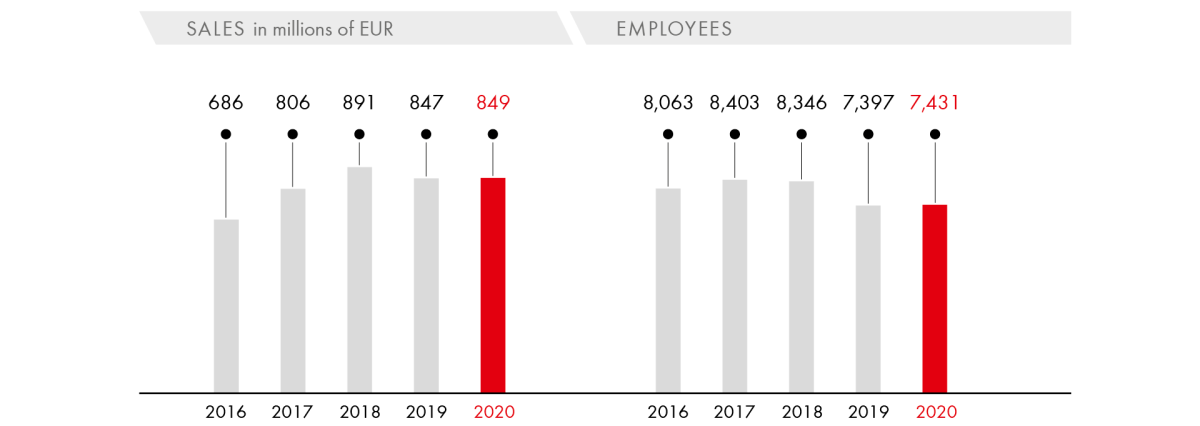

- Electrical Wholesale reaps benefits from COVID-19 pandemic: secure power supply considered “systemically important”

- Growth outstrips market trend: electrical wholesalers achieve sales in excess of EUR 2.0 billion for first time in 2020

- More than 5,600 employees

- Double-digit sales growth in German market

- Italy and Spain hit particularly hard by COVID-19 pandemic, but comparatively few restrictions on companies and satisfactory development thanks to systemic importance

- Pandemic gives extra boost to fast-growing e-commerce business

- Early moves to build up product stocks and extensive COVID-19 precautions ensure unrestricted supplies to customers during pandemic

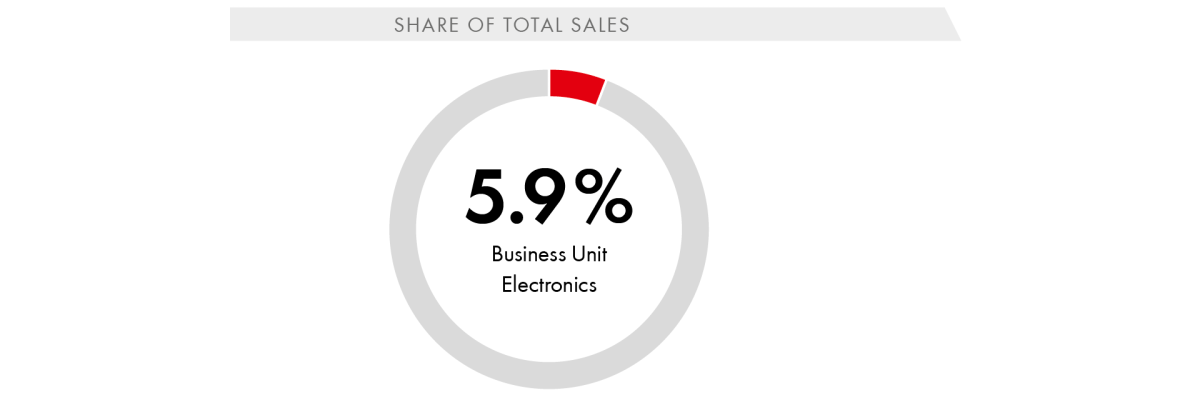

Electronics

The Electronics unit produces and sells electronic components such as printed circuit boards, electronic and electro-mechanical elements, and full system components from smart power and control systems.

- Despite challenges associated with COVID-19 pandemic, successful year overall

- Focus on digital sales solutions, trade fairs and product landscapes

- Second place as product of the year in the readers’ choice of industry magazine ELEKTRONIK for Würth Elektronik eiSos WE-LAN AQ (LAN transformer manufactured by means of full automation with innovative coil winding technique)

- German Electrical and Electronic Manufacturers’ Association (Zentralverband Elektrotechnik- und Elektronikindustrie) confirms Würth Elektronik CBT’s leading position among Europe’s printed circuit board manufacturers

- Würth Elektronik eiSos relies on more sustainable alternatives for packaging materials, such as filling material and adhesive tape made of recycled paper

- Successful structural adjustment of Würth Elektronik CBT plant in Schopfheim to ensure future competitiveness

- Relocation of Wurth Electronics ICS USA to new company site in Miamisburg, Ohio, featuring twice previous production area

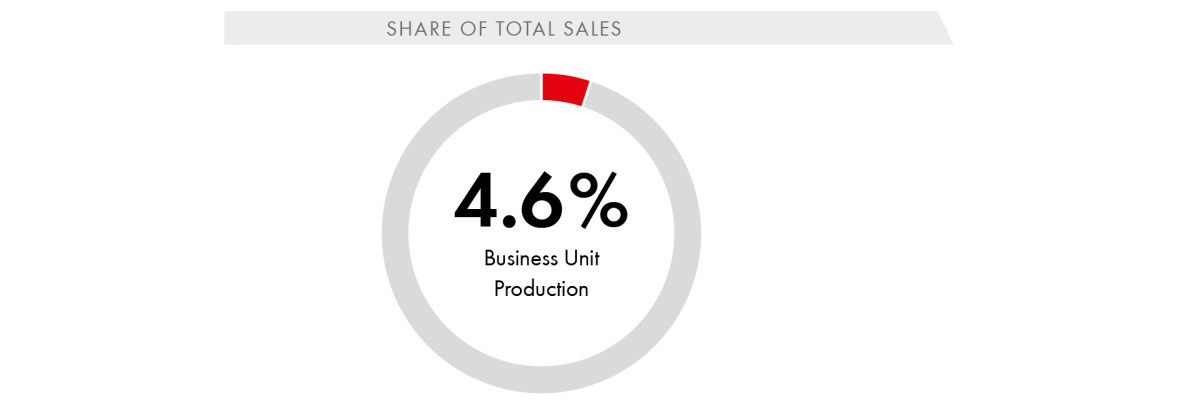

Production

The range in this business unit includes the production of cold-formed parts, forming and punching tools, a variety of fasteners and fastening systems, furniture fittings, plastic assortment and storage boxes, as well as factory and vehicle equipment. The business unit supplies a range of customers, including customers from the construction sector, the automotive industry, manufacturers of kitchens and household appliances, and wholesalers.

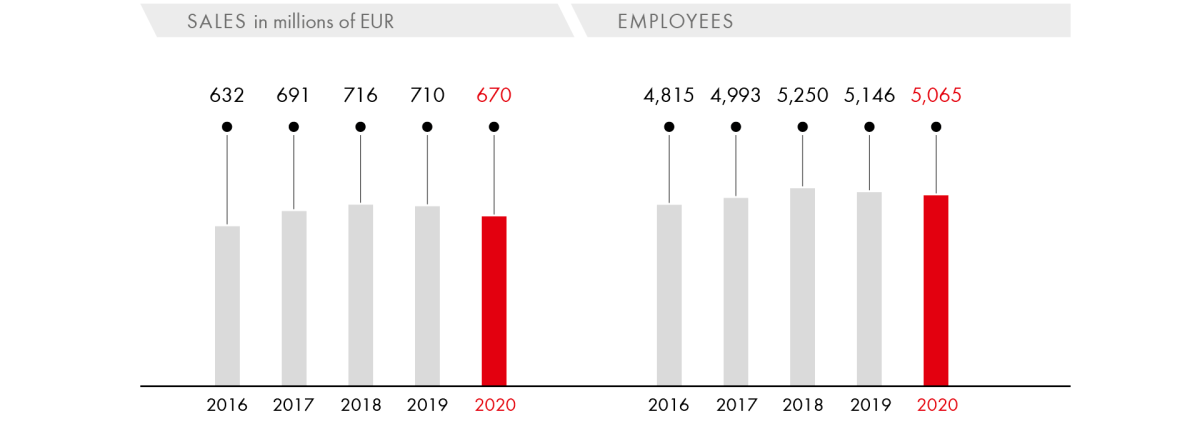

- Automotive sector hit hard by pandemic, otherwise only minor or no losses, although growth targets not achieved

- Commissioning of new production hall at SWG Schraubenwerk Gaisbach: beech roof structure considered pioneering project

- Completion of production hall spanning useful area of 13,000 m² at Arnold Umformtechnik to speed up work processes and bring the Fastening Systems and System Development areas together in one location

- FELO expands usable floor space by 1,600 m² with building extension

- Successful consolidation of Grass warehouses thanks to completion of new warehouse building in Hohenems

- Further development of Vionaro drawer system: Grass expands range to feature 8-millimeter Slim Line Drawer side made of steel

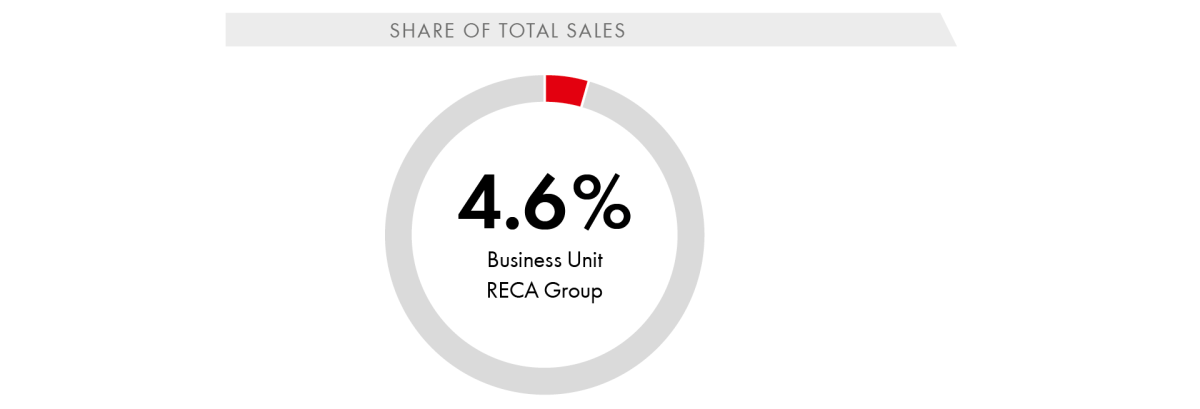

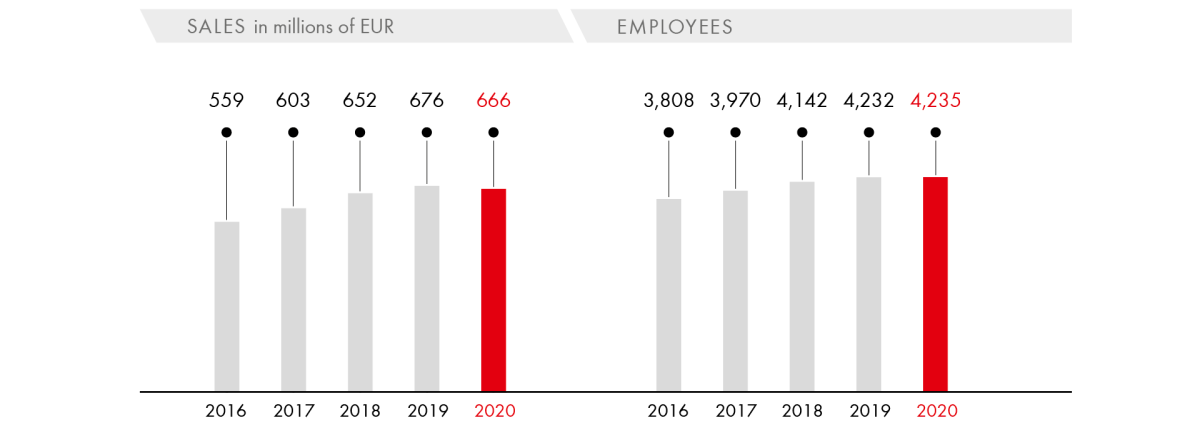

RECA Group

The RECA Group companies supply tools, assembly and fastening materials, and C parts to industry and directly to construction, wood, metal, and car business customers, as well as to customers in the cargo sector, in 19 European countries. Specialists in workwear, advertising materials, and vehicle equipment complement the company portfolio.

- Declining sales in industrial business, where impact of COVID-19 pandemic significantly more pronounced than in slightly growing craft sector

- Focus on services that help customers reduce procurement costs for small parts, such as KANBAN and RFID-supported storage systems, SECO® shelf management system (service concept) for trade customers, shelf and vending solutions for direct retrieval of goods, and automated reordering for customers

- Expansion of central logistics in Wels, Austria, to provide logistical support for growth activities in years ahead (delivery capability, service level)

- Continued good prospects for future thanks to combination of digital sales systems and customer support by traditional sales force on site and by telephone

- Tapping markets by implementing trading partner concept in (mainly European) countries in which RECA Group has not been active to date

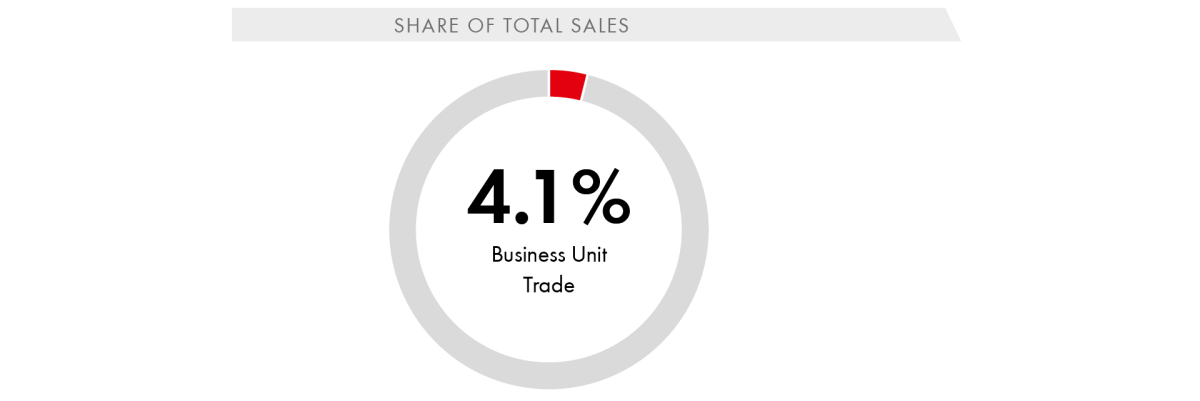

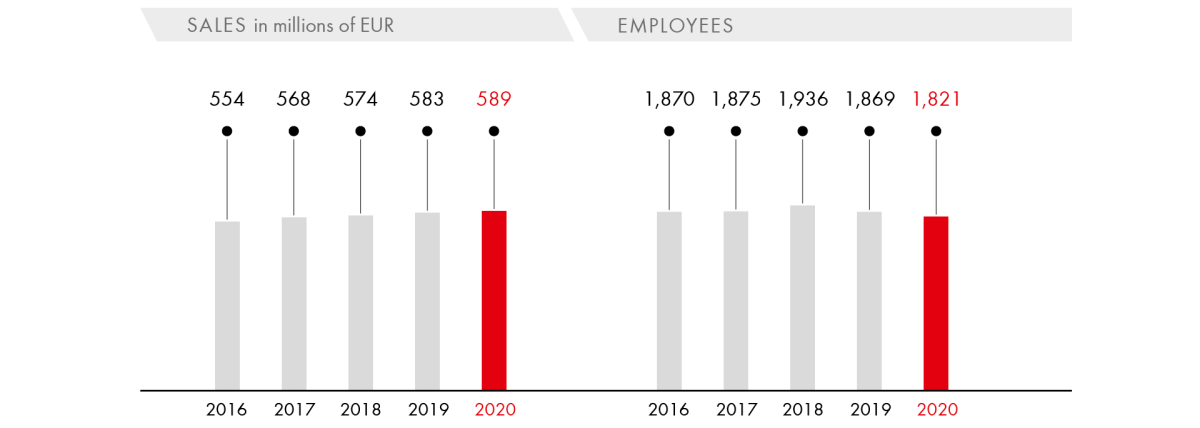

Trade

Companies in this business unit sell installation, sanitary, fastening and assembly materials, garden products, power tools, and hand tools. The range also includes furniture fittings for specialist stores and retailers as well as products for DIY stores and discount stores.

- Despite slump in sales in April, the exceptional year 2020 closed on positive note due to boom in DIY and home improvement sector sparked by the pandemic

- Expansion of e-commerce and digitalization

- Investments in IT infrastructure and forward-looking technologies such as electronic shelf labels

- Find-it shelf: newly developed all-in-one solution for stationary retail to allow products to be found on shelf in electronically controlled process

- Strengthened social media presence featuring dedicated company blogs, as well as use of new platforms

- Reduced packaging variety for better sustainability and compliance with highest environmental and safety standards based on customer specifications

- Special solutions tailored to customer needs and requirements

- Customer segmentation for optimum and targeted customer support

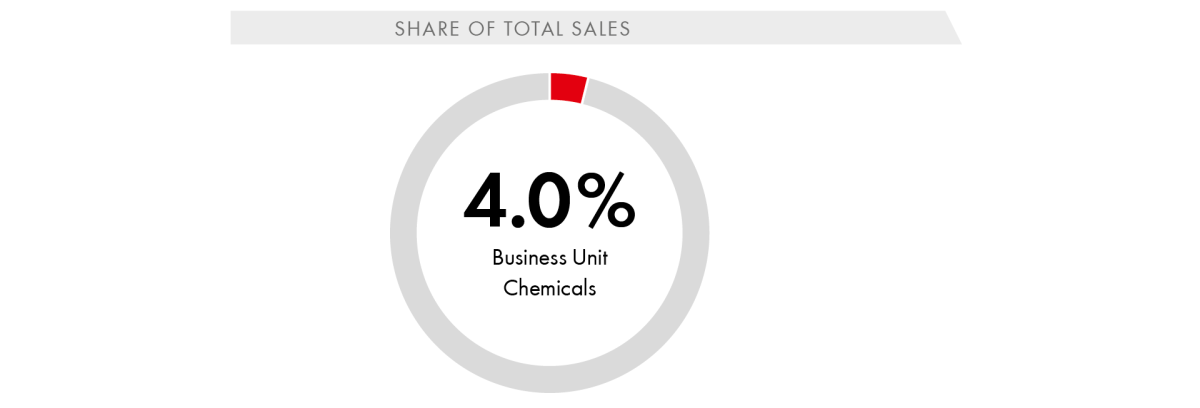

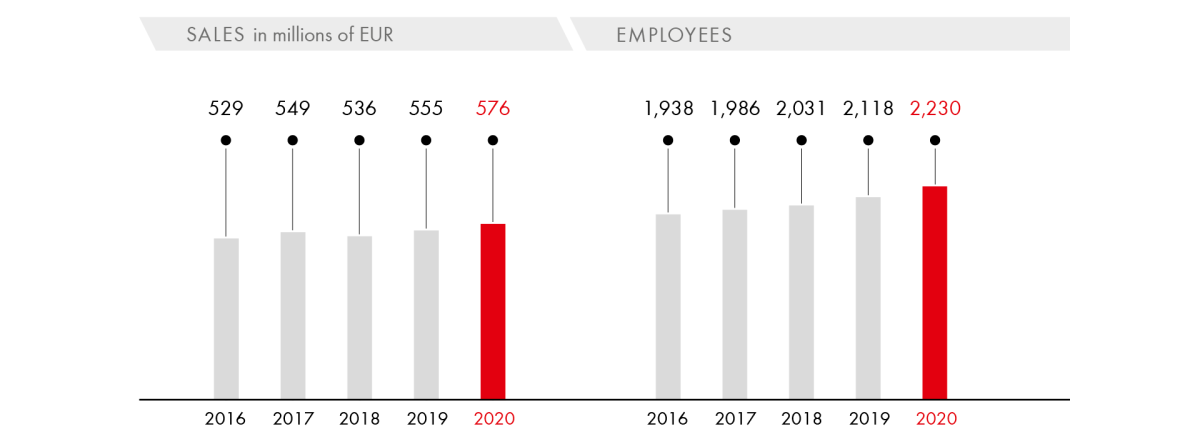

Chemicals

The companies in the Chemicals unit are responsible for the development, manufacturing, and distribution of chemical products for the automotive, industrial, and cosmetics sectors. They distribute both their own brands and private-label products and are renowned as innovation specialists and experts in their niche areas.

- TUNAP Group: positive sales development thanks to disinfectant products

- AP Winner China: new sustainable, antibacterial and VOC-reduced/VOC-free cleaners in novel, refillable spray bottles that spray like aerosols, but without propellants

- Relaunch of Dinitrol brand (corrosion protection, sealants, and adhesives) in Germany

- Increased focus on cost structures

- Promotion of digitalization in companies by expanding use of webinars

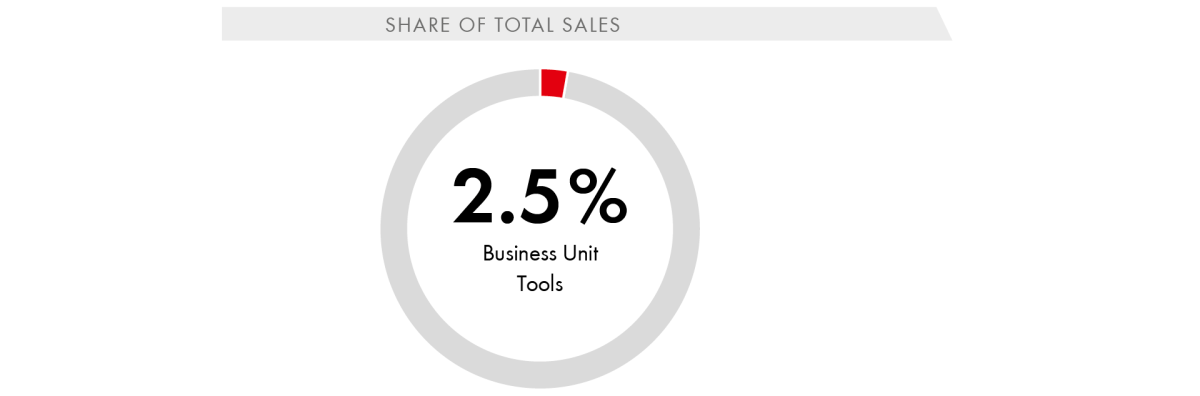

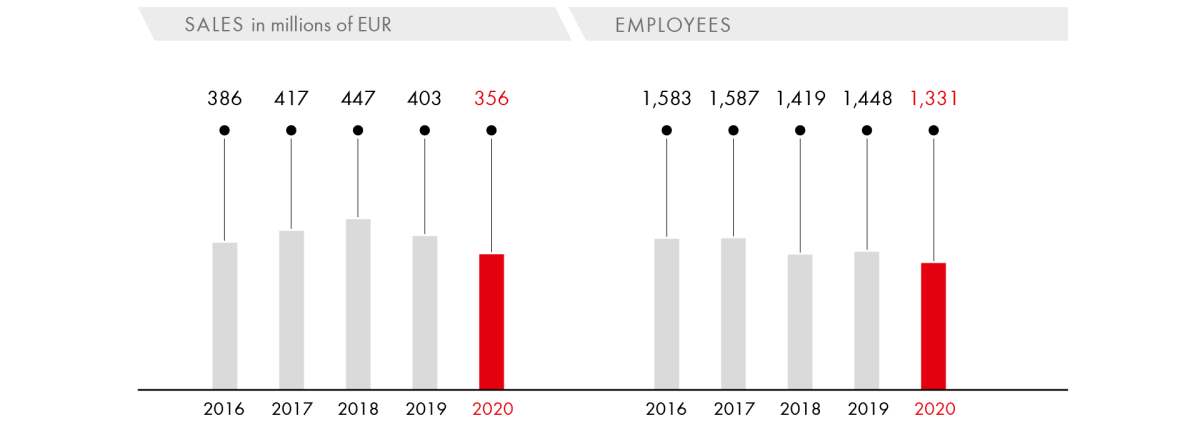

Tools

The tools companies supply customers in the metalworking and metal processing industries, particularly in the mechanical and plant engineering sector, and in the automotive manufacturing and automotive supplier industry. They sell products from the areas of drilling, milling, turning, clamping, grinding, testing and measurement equipment, hand tools, operating equipment, machinery, and personal protective equipment.

- COVID-19 crisis sparked further deterioration of economic situation for customers in mechanical and plant engineering sector and automotive industry

- Restructuring measures prompted by sharp drop in sales of 11.7 percent in 2020

- Expansion of e-business by forging ahead with web shop, EDI connection, and electronic catalogs

- Continued roll-out of SAP and online shop systems at national companies from 2021 onwards

- Expansion of data structure for 2D and 3D tool data to support digitalization of customer production processes

- Focus on customer acquisition in medical, food, transport and logistics, energy and environment, construction, and recreational vehicle sectors

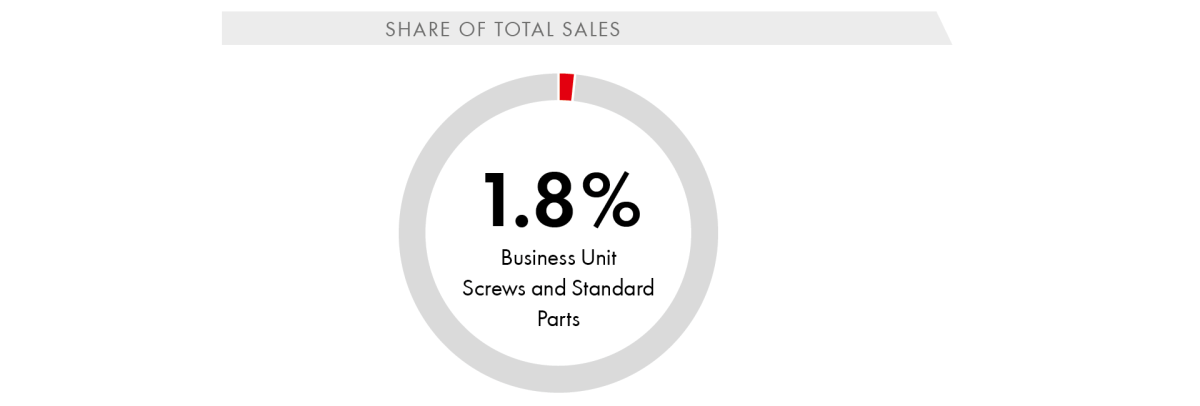

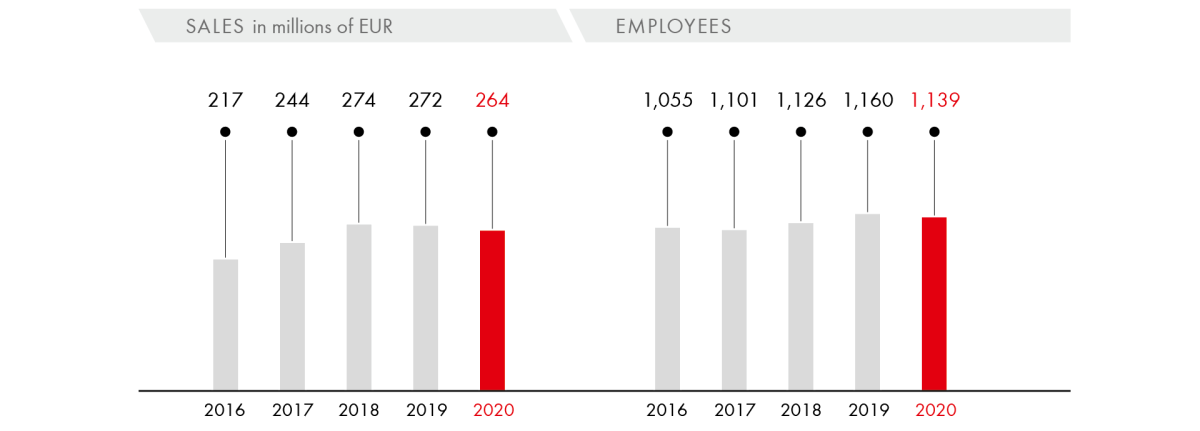

Screws and Standard Parts

The stainless steel companies are product specialists with supply concepts for industry and trade. The unit’s main business activity is the sale of stainless connecting elements, in particular DIN and standard parts. The hydraulic companies specialize in trading in hydraulic connection technology and providing the associated services.

- Compensation for drop in sales in April and May triggered by COVID-19 pandemic almost possible year progressed

- Focus on telemarketing at stainless steel companies for closer customer contact

- Service sales reported by hydraulics companies prove resilient in difficult year 2020, declining only slightly in year-on-year comparison, growing again in the last quarter

- Wholesale business sees drop in sales running into high single digits due to economic situation and pandemic

- System update to support further digitalization of processes such as EDI connections

- Preparations under way to integrate e-shop into CRM module in sales to enable optimal customer care

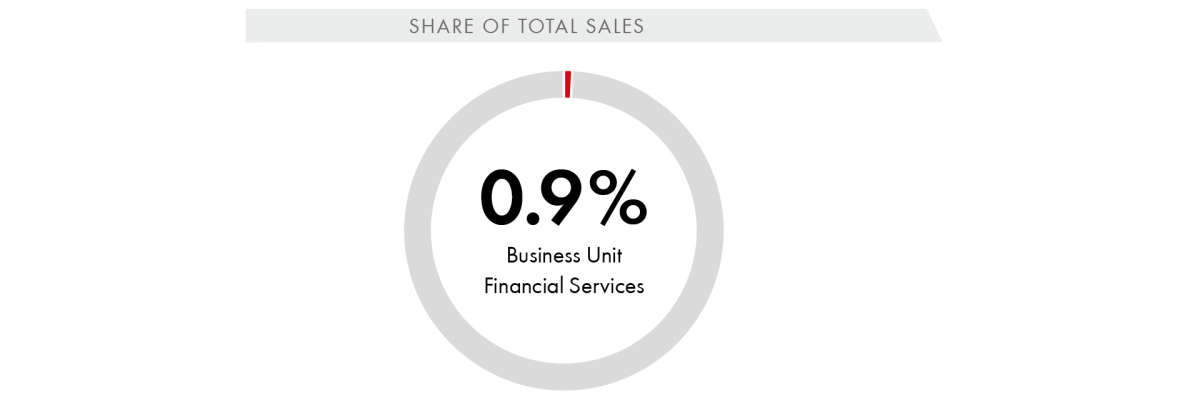

Financial Services

In addition to its conventional screw-based business, the Würth Group has also specialized in financial services for business and retail customers alike. Financing, leasing, retirement plans, property and personal insurance as well as asset management are among the services offered.

- IBB Internationales Bankhaus Bodensee AG: positive earnings development again

- Leasing companies report mixed performance due to COVID-19 pandemic: hardly any noticeable impact on new business volume in Switzerland and Denmark, Germany hit hard by developments in key mechanical engineering and automotive sectors

- Waldenburger Versicherung: earnings improve again thanks to combination of premium growth above market average and good loss ratio

- Further investments in digitalization, sales, and staff ensure future viability

- Würth Financial Services: sales record despite COVID-19 pandemic

- Successful integration of Optima Versicherungsbroker AG to strengthen market position in Switzerland

- Operating result slightly up on previous year

- Cash flow increases significantly

- Equity ratio of 43.8 percent

At EUR 775 million, the Würth Group’s operating result is slightly above the prior-year level. Due to the proportionate increase compared to sales, the rate of return remained constant at 5.4 percent (2019: 5.4 percent). We have calculated the operating result as earnings before taxes, before amortization of goodwill and financial assets, before the collection of negative differences recognized in profit or loss, before the adjustment of purchase price liabilities from acquisitions through profit or loss, and before changes recognized in profit or loss from non-controlling interests disclosed as liabilities.

The heavy reliance on the automotive industry and the mechanical engineering sector in Germany also had a negative impact in the 2020 fiscal year. The operating result in this market fell by 3.3 percent to EUR 376 million (2019: EUR 389 million). The negative trend in the industries mentioned put pressure on earnings at companies trading in tools, within the Würth Elektronik Group, and at individual manufacturing companies. The share of the Group’s overall result attributable to the German companies fell to 48.5 percent as a result, with the return on sales amounting to 6.2 percent (2019: 6.6 percent). With an operating result in excess of EUR 200 million for the first time, Adolf Würth GmbH & Co. KG made what was by far the biggest contribution to earnings of any other single company in the Group. Other top performers within Germany include: Würth Elektronik eiSos, Reca Norm, and Fega & Schmitt Elektrogroßhandel.

Restructuring measures taken in the past at established companies, such as companies specializing in fittings or the Würth Line, had a positive impact in the 2020 fiscal year. This, combined with a rapid and efficient response to the new challenges brought about by COVID-19, resulted in the companies outside Germany posting a total operating result of EUR 399 million (2019: EUR 381 million). This equates to an increase of 4.7 percent. Taking account of the fact that significantly more companies outside of Germany were affected by closures due to COVID-19 lockdowns, this is a very encouraging development. Unsatisfactory business developments at individual industrial companies in the US prevented an even more significant increase in the operating result. The situation in the United Kingdom also remains challenging due to the uncertainty surrounding Brexit. We do not, however, expect Brexit to have had any significant impact on the net assets, financial position, and results of operations of the Würth Group in 2020, nor do we expect it to have an impact on 2021.

The ratio of cost of materials to sales was up slightly on the previous year at 50.4 percent (2019: 50.1 percent). A change in the sales mix is the main reason behind this increase. At EUR 110 million, other operating income is on a par with the previous year (2019: EUR 108 million).

At the end of December 2020, the Würth Group had a total of 79,139 employees. Person-to-person contact is the strength of our direct selling approach also, and particularly, in times of the COVID-19 pandemic. The sales force works closely with our efficient in-house departments. Due to temporary restrictions on face-to-face meetings, telephone-based consultancy sessions moved into the spotlight. In order to always be available to our customers and, in particular, to be able to return to the market at full capacity after the lockdowns, the Würth Group made a deliberate decision not to make any structural staff adjustments. The decrease of 193 employees in the sales force is minor and can be attributed exclusively to normal staff turnover.

The number of employees in our in-house departments rose by 1.4 percent, an increase of 646 employees. The ratio of cost of materials to sales was up slightly on the previous year at 26.7 percent (2019: 27.0 percent). This is attributable to the fact that government support measures were available in various countries during the COVID-19 pandemic, leading to a partial reduction in personnel expenses.

Amortization, depreciation, and impairment losses increased in the year-on-year comparison to EUR 779 million in 2020 (2019: EUR 721 million). This figure includes impairment losses on goodwill, customer bases, and property, plant and equipment amounting to EUR 84.3 million, which were mainly incurred in the US industrial companies and in the Würth Elektronik Group. Amortization and depreciation were up by 6.6 percent on the previous year.

Other operating expenses fell by 4.2 percent compared to the previous year. The ratio was down on the previous year at 12.4 percent (2019: 13.1 percent). This decrease was mainly due to savings in conferencing, travel, and other mobility expenses of around EUR 100 million. Travel restrictions imposed due to the COVID-19 pandemic led to a significant reduction in global mobility.

The tax rate increased in the 2020 fiscal year to 19.9 percent (2019: 18.8 percent). One of the main reasons behind this trend is that in the 2020 fiscal year, profits were increasingly generated in countries with higher tax rates, resulting in an increase in both the theoretical and the actual tax rate. For a detailed analysis, please refer to Section G. Notes on the consolidated income statement, [10] “Income taxes”, in the consolidated financial statements.

The Würth Group achieved a new sales record of EUR 14.4 billion in the last fiscal year in spite of the global pandemic. The operating result increased slightly thanks to stringent cost management. The Würth Group closed the fiscal year with an operating result of EUR 775 million. Net income for the year increased to EUR 604 million. Our gross profit, that is to say, sales minus the cost of goods sold, came under pressure due to developments on the global procurement markets. By contrast, staff turnover and sales per employee improved at an above-average rate compared with previous years. 2020 was an exceptional year. The outbreak of the first wave of COVID-19 in the Western world in March 2020 triggered a historic drop in sales of more than 20 percent for the Würth Group in April. The scenarios developed in response to this for 2020 as a whole envisaged a double-digit drop in sales. Against this background, the Central Managing Board is very satisfied with the sales growth of 1.0 percent. The operating result also outstripped expectations, taking into account the situation created by the pandemic last year.

Capital expenditures and cash flow

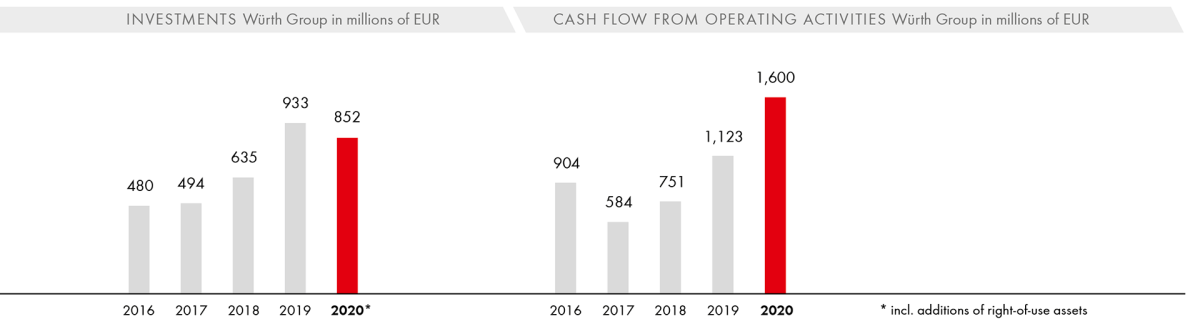

Growth is inextricably linked to the self-image of the Würth Group. Growth by tapping into new markets and growth in existing markets require optimal overall conditions. One of the ways in which the Würth Group achieves such conditions is through sustainable investment. Over the past ten years, the Group has invested more than EUR 5.0 billion in intangible assets and in property, plant, and equipment. In 2020, global economic forecasts were revised downwards significantly from March onwards with the emergence of the COVID-19 pandemic, and economic development proved difficult to forecast for the Würth Group, too. Nevertheless, the Group continued to pursue planned investment projects, some of which had already been launched, and made investments (excluding right-of-use assets under IFRS 16) totaling EUR 473 million in the fiscal year under review (2019: EUR 705 million), corresponding to a decrease of 32.9 percent. The lower figure can be traced back to the fact that planned investment projects that were not directly related to an expansion of sales capacities or that were designed to optimize and expand services rendered by manufacturing companies were canceled, curtailed, or postponed to the following year.

All in all, investments in 2020 focused on the expansion of IT infrastructure and warehouse capacities for our distribution companies, as well as on production buildings and technical equipment and machinery for our manufacturing companies.

Kellner & Kunz AG, Austria, made the biggest investment in its history, expanding the central logistics facility in Wels. The trading company is an expert in the distribution of screws, tools, DIN and standard parts, as well as service systems in C-parts management, and has a product range encompassing around 120,000 top-quality products. The planning phase for the logistics expansion project began back in 2016, and the commissioning of the facility was finalized successfully at the end of 2020. This logistics expansion consists of an automated small parts warehouse comprising 200,000 bin bays, a high-bay warehouse with 15,400 pallet bays, and a functional logistics building consisting of a total of four levels, also featuring a shuttle system with 16,000 bays. The expansion project has added a total of 18,000 square meters of logistics space across all floors. The total amount invested came to around EUR 48.8 million.

Logistics capacities were also expanded at IVT GmbH & Co. KG in Rohr near Nuremberg. The first phase of construction was completed in the fall of 2020. A total of 25,000 square meters of land is available for construction, on which 500 additional storage bays were initially created in the form of a high-bay warehouse and a block-type warehouse spanning an area of 1,200 square meters. Thanks to the expanded logistics wing, it is now possible to deliver the new IVT stainless steel pipe system to customers nationwide within 24 hours. The second construction phase will involve the expansion of the total usable space for production and logistics to 7,000 square meters and is scheduled for completion by the end of 2024. The total amount invested in both construction phases comes to around EUR 15 million.

In addition to the Allied Companies, the Würth Line companies also made substantial investments in stepping up their sales activities. Würth Finland, for example, continued its successful pick-up shop strategy by building four new pick-up shops. The share of sales generated by pick-up shops in Finland is now almost 50 percent. The company now has a total of 189 locations where customers can cover their immediate needs. The total investment volume for expanding the pick-up shop network amounted to EUR 5.7 million at Würth Finland in 2020.

Despite the crisis, the Group is stepping up its innovation strategy as planned: In March 2019, the groundbreaking ceremony was held at the Künzelsau site for the construction of the Innovation Center, which is scheduled to open in 2022. The total amount invested comes to around EUR 70 million. Modern laboratories and workshops are being built on an area spanning 15,000 square meters. A climate chamber, the latest 3D printers, and seismic test stations for anchor technology offer a wide range of opportunities to strengthen and advance Würth’s in-house research in the long term.

In addition to investments in production and storage space, we have also, as in previous years, invested in our ORSY® storage management system, which offers our customers storage and provision options for various consumables and supplies in line with their needs.

In total, EUR 245 million, or 51.8 percent of the investment volume, was attributable to Germany, reflecting the continued paramount significance of the home market for the Würth Group.

Thanks to our efficient investment controlling processes using sophisticated recording and analysis tools, the Central Managing Board is always in a position to react quickly to changes in the overall environment. In 2020, for example, one crisis management measure was to set more stringent limits on the approval of capital expenditure amounts. The focus here was on maintaining the Würth Group’s stability and liquidity. There were no across-the-board investment cuts so as to ensure that necessary investments, for example, in the expansion of additional sales capacities, could continue to be made.

Thanks to all of the measures taken, we once again achieved our objective in 2020 of financing investments in intangible assets and property, plant, and equipment entirely from our operating cash flow, which amounted to EUR 1,600 million (2019: EUR 1,123 million), up by 42.5 percent on the previous year. The main reasons behind the strong growth, achieved based on unchanged earnings, were higher depreciation, amortization and impairment losses, increased risk provisions for inventories and receivables, moderate growth at financial service providers compared with the previous year, and salary components that had not yet been paid out.

Purchasing

The COVID-19 pandemic had a significant impact on the procurement markets in 2020. This is confirmed if we take a look at the purchasing managers’ indices for the world’s three leading economic areas (eurozone, US, China), which serve as leading indicators of developments in these regions. Each of these indicators showed a significant drop between February and May 2020 before bouncing back in the months that followed. As a result, the purchasing managers’ index for the eurozone again exceeded the important 50-point expansion threshold from July 2020 onwards and stood at 55.2 points at the close of the year. This suggests that leading buyers in this economic area expect to see positive market developments in 2021. The purchasing managers’ index in the US was even more volatile. It bottomed out at 41.5 points in April and rose to 60.7 points by December 2020. The index for the People’s Republic of China was much more stable. After touching on a low of 40.3 points in February, the index recovered to 53.0 points by December.

The situation for the Würth Group’s buyers in 2020 was a very challenging one: On the one hand, production capacities were repeatedly unavailable in the course of the year due to regional measures to combat the pandemic. On the other, customer demand for a large number of products slumped significantly, especially at the peak of the COVID-19 pandemic in the first half of 2020. By contrast, demand for personal protective equipment products, such as face masks and disposable gloves, rose sharply. The production capacities available worldwide were far from sufficient. This development is ongoing in some cases and will also have a marked impact on the procurement markets in 2021.

Two effects came to light on the procurement markets in the second half of 2020. On the one hand, a special economic situation with above-average customer demand was observed following the lockdowns in the global sales markets in the first half of the year, inevitably resulting in longer delivery times and high levels of capacity utilization among suppliers. On the other, it was particularly noticeable in the second half of the year that regional decisions to step up the pandemic measures prompted a drop in production capacities worldwide. Accordingly, buyers were forced to juggle the conflicting priorities of a significant increase in customer demand and lower available production capacities on the supplier side.

The euro/dollar exchange rate was also heavily influenced by the pandemic in 2020. In addition, the US presidential elections in November 2020 failed to translate into any sustained increase in the value of the US dollar. While the dollar was trading at USD 1.123 per EUR at the beginning of 2020, it had climbed to as high as USD 1.224 by the end of the year. This exchange rate trend had a positive effect on the results of the importing purchasing companies.

By contrast, cargo rates for container handling at shipping ports in Asia rose significantly over the course of 2020. In the wake of the COVID-19 pandemic and the strict lockdowns imposed in Asia, shipping companies tightened up their freight capacities, meaning that the capacities available were completely booked up from the summer onwards. At the same time, demand for air freight from Asia increased enormously, which also meant longer delivery times for finished products.

The value management function launched in 2019 was established and expanded further in 2020. The aim is still to use value analysis approaches to strengthen product price transparency within the Purchasing function of the Würth Group so as to provide additional support to buyers in their negotiations with suppliers. This is designed to help counteract the price development expected for 2021. Further analysis projects were defined in the purchasing companies as a result.

Inventories and receivables

As a company with international operations, the Würth Group’s inventories and receivables are key balance sheet items that the company’s management is continually seeking to manage and optimize. Both balance sheet items allow for short-term controlling and optimization of liquidity and tied-up capital in the Group, something that proved crucial in the fiscal year under review.

The Würth Group’s inventories increased significantly during the first COVID-19 wave between March and May 2020. Due to the drastic drop in sales in April and May and the fact that orders placed earlier continued to arrive in the warehouses, inventories peaked at a value of EUR 2,385 million in May.

From the very start of the pandemic, inventory control measures were stepped up in close coordination with the established companies, the aim being to bring inventory development in line with the sales situation as quickly as possible. At the same time, the Würth Line’s Central Purchasing department pushed ahead with projects to streamline the range of products on offer in cooperation with Product Management in order to eliminate products with very low demand.

These activities resulted in an ongoing reduction in the Würth Group’s inventories in the months that followed. At the end of the year, the Group’s inventories came to EUR 2,222 million, EUR 163 million lower than the peak reached in May and as much as EUR 66 million lower than one year earlier (2019: EUR 2,288 million). Stock turnover, calculated on a 12-month basis, fell slightly from 4.7 times at the end of 2019 to 4.6 times at the end of 2020.

Alongside sales, logistics is a central element within the Würth Group. The rapid implementation of precautionary measures in logistics processes ensured that supply capability remained consistently high throughout the year. The service level in 2020 was 96.7 percent, meaning that 96 out of 100 items ordered were delivered to the customer the next day. This service allowed us to be a reliable partner for our customers even in an environment dominated by the pandemic.

COVID-19-related lockdowns lasting weeks in many sectors, worldwide border closures, and the associated disruption to supply chains, coupled with the shutdown of entire production plants in the spring and early summer of 2020, fueled fears of large-scale company insolvencies and associated massive losses caused by bad debt, or at least delayed incoming payments. The top priority was therefore to safeguard liquidity in the Würth Group. One of the ways in which we did this was by keeping a close eye on the development of receivables. In this situation, too, the Würth Group was able to rely on its established, sophisticated controlling systems, which allow the Group to take fast action in response to any undesirable developments that may emerge. Thanks to extremely efficient interaction between sales and receivables management, and despite slightly rising sales, the Group actually succeeded in reducing its trade receivables by 1.7 percent to EUR 1,942 million (2019: EUR 1,975 million). This very encouraging development is also reflected in the level of receivables in relation to sales. At 53.0 days, the corresponding key figure, collection days (based on a 12-month calculation), was significantly lower than the figure for 2019 (54.8 days). An excellent result was achieved in Germany, in particular, with 40.0 days (2019: 42.2 days).

We will continue to optimize accounts receivable by means of effective cooperation between sales and accounts receivable management, as well as by refining our analyses. We see the payment patterns of debtors as critical in Southern Europe, China, the Middle East, and India, as they can slow growth.

The percentage of bad debts and the expenses from additions to value adjustments related to sales increased slightly to 0.6 percent (2019: 0.4 percent).

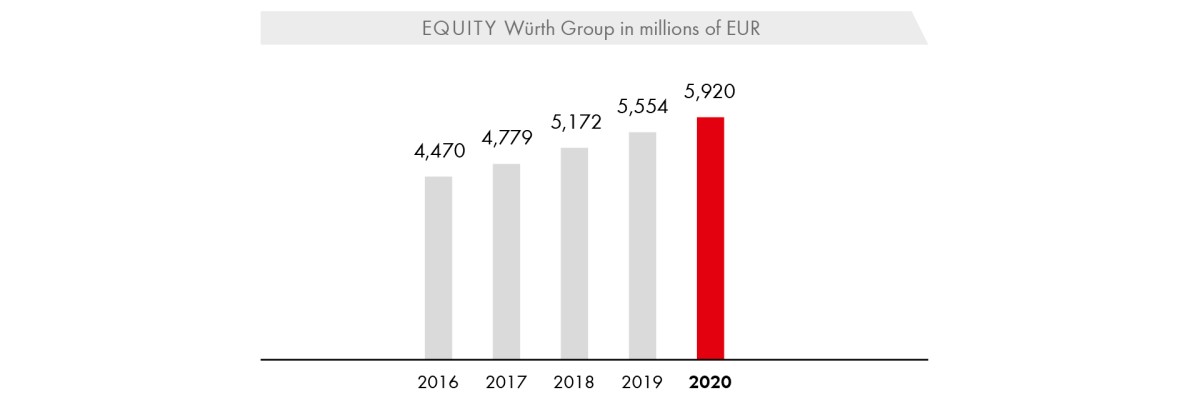

Financing

The equity of the Würth Group climbed by 6.6 percent to EUR 5,920 million in the past year, an increase of EUR 366 million. This increase allowed the company to keep its equity ratio more or less stable at a level of 43.8 percent, which is high for a trading company (2019: 44.0 percent). For years, a good level of equity capitalization has been the basis for consistently high levels of financial stability and the solid financing of our group of companies, strengthening customers’ and suppliers’ trust in the Würth Group. This is due to the typical family business approach of reinvesting a large portion of profits in the company. The high level of equity financing allows the company to be relatively independent of external capital providers, which is a must particularly in times of crisis.

Total assets rose by EUR 851 million to EUR 13,478 million (2019: EUR 12,627 million). The increase of 6.7 percent is due primarily to the increase in cash and cash equivalents. This is thanks to the issue of a new bond and a stringent spending policy. As a result, net debt fell significantly to EUR 601 million as against EUR 1,356 million in 2019.

Financial service activities also contributed to the growth in total assets, albeit not to the same extent as in the previous year. Refinancing in the banking sector was mainly achieved through financial intermediaries and refinancing programs launched by the European Central Bank, while refinancing in the leasing segment was achieved mainly through the ABCP (Asset Backed Commercial Paper) program created especially for this purpose, a global loan program launched by the German state-owned development bank KfW, as well as through non-recourse financing and internal funds.

The Würth Group has undergone an annual rating process for 25 years now. The leading rating agency Standard & Poor’s once again confirmed the Würth Group’s “A /outlook stable” rating in 2020. This rating reflects the confidence that business and the financial KPIs will continue to develop successfully, even in the environment created by the pandemic. The opportunities and outlook for the Würth Group are viewed in a positive light. Our long history of good ratings not only documents the positive credit rating; at the same time, it is proof of the continuous and successful development of our corporate group and the stability of our business model.

Last spring, the Würth Group took advantage of the attractive conditions on the capital markets to raise long-term funds and successfully placed a EUR 750 million bond on the market via its finance company Würth Finance International B.V. on 11 May 2020. This issue, the largest to date, is an important component of the Würth Group’s capital market-oriented financing strategy. The bond, which has a term of 7.5 years, has a coupon of 0.75 percent p.a. and is secured by an unconditional, irrevocable guarantee provided by Adolf Würth GmbH & Co. KG. It was used, among other things, to repay a EUR 500 million bond that matured in May 2020. At the end of the 2020 fiscal year, the Würth Group had three bonds issued on the capital market and one US private placement. All covenants in this context have been observed. In 2022, 2025, and 2027, bonds worth EUR 500 million and EUR 750 million will reach maturity, while the US private placement of USD 200 million is set to reach maturity in 2021. This means that the maturities are well spread out. For further details on the maturity profile and interest structure, please refer to [27] “Financial liabilities” in Section H. Notes on the consolidated statement of financial position, in the consolidated financial statements.

The Würth Group has sufficient liquidity reserves. As of 31 December 2020, cash and cash equivalents came to EUR 1,386 million (2019: EUR 477 million). In addition, the Group has a fixed undrawn credit line of EUR 400 million provided by a syndicate of banks until July 2023.

In addition to successful sales and outstanding logistics, new products and innovations as a service to our customers are crucial when it comes to securing the competitive standing of the Würth Group.

In the 2020 fiscal year, for example, Adolf Würth GmbH & Co. KG generated one-fifth of its sales from products that are less than three years old. Given the breadth and size of the range that Würth offers its customers, this number is very high. The issue is also a priority throughout the Group: At present, the Group has 781 active patents, 8 utility models, 934 registered designs, and 7,749 active brands.

Developments within the Würth Line

Adolf Würth GmbH & Co. KG

ASSY®4: enhanced special screw for top performance in structural timber engineering

With the ASSY®4 innovation screw, Würth has introduced a new generation of the tried-and-tested wood construction screw that is widely used in timber construction. In cooperation with the development department of Adolf Würth GmbH & Co. KG, the production team at SWG Schraubenwerk Gaisbach was able to make its contribution to the successful series production of the product with its manufacturing expertise. The 1,400 different dimensions for the core range alone are testimony to the scale of this project. The most important further developments include a gently expanding screw tip with a linear rise in the counter thread to reduce splitting, a newly developed thread that pulls boards together much better, optimized milling pockets for fast and clean driving in of the screw, and the completely new RW screw drive. The main feature of the new RW drive is the extended, reinforced, and beveled bit wings, which allow the bit to penetrate particularly deeply into the screw head of the ASSY®4. This allows for a better transmission of forces. The RW drive also creates a clamping effect between the screw and the bit. This means that the screws stay reliably attached to the bit even without magnetic force. The improved transmission of forces also allows the required bit sizes to be reduced to a total of four, meaning fewer bit changes when working with different screw dimensions. Compared to the predecessor model, the screw features an increased number of milling pockets for smaller diameter screws. Especially in cases involving timber materials with a brittle melamine coating, this prevents unwanted fraying and, as a result, visible surface flaws around the countersunk screw head. In screws with metal fittings, the milling pockets have a braking effect that improves the friction-fit with the fittings.

HSCo Multi Performance combination screw tap:

pre-drilling, thread cutting, and deburring—all without changing tools

The new HSCo Multi Performance combination screw tap combines all steps involved in making through-holes with internal threads in just one operation without having to change tools. The drilling depth has been increased to twice the drill diameter, twice that of conventional combination screw taps. In addition, it is suitable for almost all common materials—from conventional structural steels and casting materials to stainless steels and non-ferrous metals. This allows for more versatile and efficient applications. The tool can be used on cordless drills as well as on hand-held, pillar, and upright drills. A polygon shaft ensures safe power transmission from the machine to the combination tool.

WIT concrete screw anchor system:

install anchors quickly and securely in concrete like never before

The combination of the W-BS concrete screw and the two-component WIT-BS concrete screw mortar creates the WIT concrete screw anchor system, which allows for unprecedented tensile loads in concrete. The anchor system, which has been approved by building regulatory authorities, is particularly suitable for the fast and secure fastening of heavy load-bearing elements such as steel and timber structures, facades, railings, or even pipe and cable shafts. Unlike conventional chemical anchors, the WIT concrete screw anchor system offers a major advantage in that it can bear a partial load immediately after being screwed in, without having to wait for the mortar to dry completely. Once the mortar is dry, the load-bearing capacity of the system increases significantly. This can be illustrated using the example of a size-10 concrete screw and an effective anchorage depth of 110 millimeters, for which the load-bearing capacity in cracked concrete increases from 9.6 kN to 19.8 kN. In addition, variable anchoring depths and options to select load-bearing capacities also allow particularly cost-effective anchoring solutions to be implemented.

Driverless transport systems in the new central logistics hub

The central logistics hub in the Gewerbepark Hohenlohe industrial park has a surface area of around 50,000 square meters. In the wide-aisle warehouse, nine automated guided vehicles (AGVs) are used to cover the long transportation routes. They support employees in their processes and take work off their hands so that they can focus on picking and packaging. The AGVs automatically transport the picking trolleys, loaded with goods, from one picking station to the next. Employees place the finished picked orders on the picking trolleys and the AGVs transport them from the picking area to the packaging area. Operating on a two-shift schedule, the AGVs currently make around 700 journeys from the pick-up station to the destination station, covering a distance of approximately 64 km. The AGVs first have to be integrated into the logistics processes so that they can navigate independently through the warehouse. The system and the capacity of the AGVs are optimized on an ongoing basis in order to achieve continual increases in productivity.

Cradle to Cradle Certified™ certification for packaging made from 100 percent recycled plastic waste

Würth and packaging manufacturer rose plastic have launched a pilot project for recyclable packaging solutions. They developed packaging made from 100 percent post-consumer recyclate (PCR), that is, plastic waste from the dual system that is collected throughout Germany. It is separated from other materials, split into size categories, sorted by type of plastic, ground, washed, melted, filtered, and re-granulated to be turned into new resources. The labels are also made of 100 percent recycled plastic and are affixed using ecologically friendly adhesives. This allowed the new packaging to secure Cradle to Cradle™ certification. The first step will involve using the recycled packaging for products in the cutting tools sector. The move to the new packaging will save around 45 metric tons of new plastic a year and will reduce CO2 emissions by 77 percent.

Würth Italy

HoloMaintenance Link

The HoloMaintenance Link platform allows tradespeople to manage consultation, support, and maintenance requests interactively and respond to them remotely by leveraging the potential of augmented and mixed reality. The customer clicks on a link received via SMS, e-mail, or chat and starts a video call from a mobile device. The tradesperson can then give the customer step-by-step instructions remotely to guide them through the necessary activities using augmented and mixed reality models, 3D animations, and technical documentation. At the end of the support call, HoloMaintenance Link automatically generates a ticket documenting the call history. By allowing for quick, solution-focused assignments, the platform streamlines the workflow and reduces the tradesperson’s costs. HoloMaintenance Link is a joint project launched by Würth Italy, Microsoft Italia, and Hevolus Innovation, Microsoft’s international mixed reality partner and Würth Italy’s technology partner for open innovation initiatives.

Würth Automatic Store

The Würth Automatic Store allows customers in Italy to buy products using a self-service function—24 hours a day, seven days a week. The fully automated store contains more than 2,000 items that can be selected via touchscreen and are always in stock. Likewise, orders placed via the Würth App or on the website can be collected in a contactless process at any time. The store is flexible and can be transported from one location to another by truck as required. The store does not have to be staffed by employees and no costs are incurred for rent, electricity, and heating. The first prototype is located in Sommacampagna near Verona. More Automatic Stores across the country will follow.

Developments within the Allied Companies

The Allied Companies of the Würth Group also continued to invest in the development of products and services to offer their customers the best possible solutions in 2020.

Würth Elektronik eiSos: Horticulture LEDs

“Horticulture lighting” describes the use of light to optimize plant growth. Würth Elektronik eiSos performed research in this area and developed special LED lamps that it is making available to the greenhouse laboratory center at the Technical University of Munich for joint research so that they can contribute to our nutrition in the future. The Horticulture LEDs make it possible to produce food all year round irrespective of the weather conditions (vertical farming). The wavelengths selected for plant cultivation promote photosynthesis and optimize plant development. In trials, tomatoes exposed to Horticulture LEDs produced up to 14 percent more flowers in winter than those exposed to other plant cultivation lamps. At the same time, energy consumption was reduced by up to 70 percent. As each plant requires different lighting conditions to grow and thrive, individual light recipes are developed. To allow every developer to replicate the experiments themselves, the Lighting Development Kit was developed as part of the project. Among other things, it features the Magl³C Multi Color LED Driver power module and the Horticulture LEDs, while it is also being used for basic research into new horticulture lamps and is accelerating their development considerably. In addition, developers have the option of using the WEilluminate app, developed by Würth itself, to control the individual LED strands. This underscores eiSos’ commitment to green electronics—the use and application of highly efficient energy-saving components and solutions to conserve resources and make innovative solutions available to the market for reducing CO2 emissions and waste.

Würth Elektronik CBT: Project CHARM—robust electronics for harsh industrial environments

Digitalization is the most important prerequisite for strengthening the competitive standing of Europe’s manufacturing industries. The options for the implementation and use of digitalization are, however, limited by the harsh environmental conditions associated with manufacturing processes, for example. High temperatures and humidity, as are common in paper production, dust formation, and strong vibrations during mining operations often lead to the premature failure of the electronics involved. The objective of the CHARM (Challenging Environments Tolerant Smart Systems for IoT and AI) research project is to develop technologies that are capable of tolerating harsh industrial environments. As part of the project, Würth Elektronik CBT is developing assembly and interconnection technology for robust assemblies at the PCB level. These assemblies are equipped with integrated sensors and flexible film and sensor systems. All components have to be designed to withstand the combination of severe thermal, mechanical, and chemical stresses. To ensure this, special protective housings for electronic components are being used that go beyond the current state of technological progress.

WTN: pioneering 3D metal printing technology

With the help of 3D metal printing, also known as “additive manufacturing,” complex components—which stand out due to their lower weight and greater functional scope—can be produced within a very short period of time. Taking the example of a mounting fixture manufactured by WTN from stainless steel (1.4404) and plastic, it was possible to save around 2.5 kg of weight per fixture by optimizing the topologies (support structures). Since the fixture is folded open and closed about 700 times a day, around 1.75 tons less weight has to be moved per day.

TUNAP: airco well sensor

Germs and bacteria: TUNAP has responded to what is currently an increasingly topical issue and now offers sustainable improvements for vehicle interiors. The airco well air conditioning cleaning system removes germs, bacteria, and mold at the source—on the evaporator and in the pollen filter box. Thanks to the cleaning system, germs are flushed out by a high-pressure jet and all the affected components are thoroughly cleaned. Now, a sensor is being launched to allow for the rapid measurement of bacteria and pollutant levels in vehicle air conditioning systems. The airco well sensor checks the air from the air conditioning system for pollutants and bacteria and lets you know when the air conditioner needs to be cleaned. The improved air quality is then analyzed and documented.

Arnold Umformtechnik: Flowform® Plus